THE ARTICLE PROVIDES EASY-TO-UNDERSTAND INSIGHT ABOUT TIN NUMBER. READ THOROUGHLY TO FIND OUT WHAT A TIN IS, WHAT ARE THE TYPES OF IT, HOW IT IS FORMATTED, AND HOW TO OBTAIN ONE.

There is a massive amount of data of hundreds of million US citizens that must be processed by the IRS. The challenge of organizing the data is not merely due to the sheer volume of it, but also due to the tricky part of identifying the people. Therefore, there should be an adopted system for tax purposes that are used to keep track of individuals other than names because they often overlapped with each other. This is what the taxpayer identification number or TIN number is for.

What is the TIN Number?

Taxpayer Identification Number (TIN) is a series of digits that’s used for identification purposes by the Internal Revenue Service (IRS). The TIN number is actually an umbrella term that comprised of several types of identification numbers to file tax for both individuals and businesses entity.

TIN is either issued by the IRS or the Social Security Administration (SSA). The only TIN that’s issued by SSA is Social Security number (SSN), while IRS issued the remaining types of TINs.

What Are the Types of TINs?

As mentioned before, TIN is a term used to covers a few types of identification numbers. All of the types are comprised of exactly nine digits.

Below are five main types of Taxpayer Identification Number:

Social Security Number (SSN)

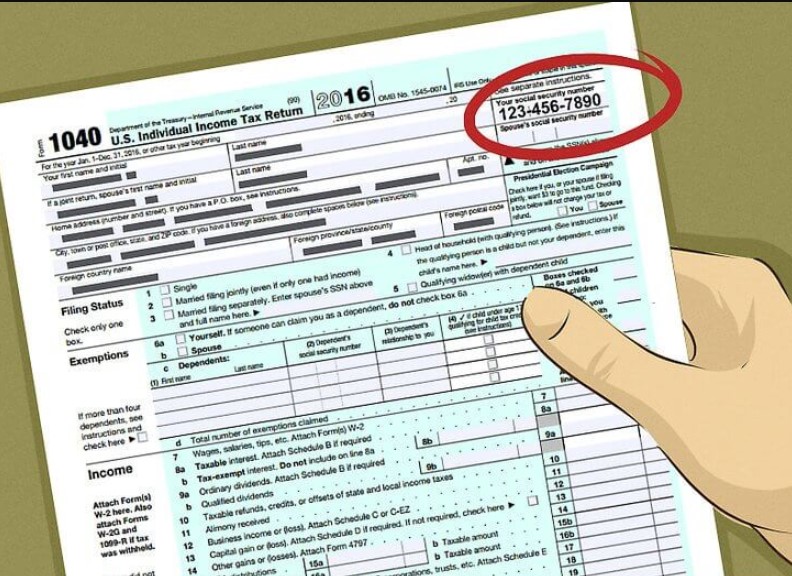

This number is issued for the individuals (citizens, permanent residents, or some temporary residents of the U.S). SSN is formatted as xxx-xx-xxxx. This number is required in order to obtain legal employment in the United States and to gain government services such as social security benefits.

Employer Identification Number (EIN)

EIN is used by the IRS to identify tax-eligible businesses, trusts, and estates. Similar to the SSN, this tax ID number for the employer also contains nine digits, but it is formatted in xx-xxxxxxx.

Individual Taxpayer Identification Number (ITIN)

ITIN is issued by the IRS for certain resident aliens and non-residents, along with their spouses and dependents who aren’t eligible for SSN. It is arranged as xxx-xx-xxxx, which exactly the same format as SSN, but ITIN always begins with the digit 9.

Taxpayer Identification Number for Pending U.S. Adoptions (ATIN)

ATIN can be applied solely for domestic adoption whose adoptive parents cannot obtain the SSN of the child, in order to gain their tax returns accurately.

Preparer Taxpayer Identification Number (PTIN)

PTIN is IRS-issued series of digits that’s used to provide tax return preparers. The number is used as the identification number for the tax return preparers. It must be attached in the section of Paid Preparer in the tax return that’s arranged for compensation.

The majority of individuals use Social Security numbers when they are required to provide a TIN number. Sole proprietors who do not employ anyone under their business can use either SSN or EIN, while companies, partnerships, estates, and trusts should provide EIN that’s assigned to them by the IRS.

Why Do I Need TIN?

Taxpayer Identification Number is a mandatory item to be provided by taxpayers when they are about to file a tax return each year to IRS. The agency will use it to identify them, just as the name signifies. The taxpayers should also include the number inside the documents related to tax filing or when they’re going to claim government’s services or benefits.

Is There Any Other Purpose of TIN?

There are also other purposes serves by TIN other than for the documents provided for the federal government, which are:

For Credit Purpose

The financial institution, such as bank and fund lenders, requires SSN when the customers apply for credit. The information is provided for the bureaus of credit in order to make sure that the application is performed by the right person. The TINs, or particularly SSN, are also used by agencies to track and report the credit history of the individual applicants.

For Employment Purpose

SSN is required to be provided by the job applicants who apply for employment in order to make sure that they are authorized to work in the U.S. The validity of the numbers must be verified by the employers to the issuing agency.

For State-Level Agencies

Corporations or businesses are required to file their state-level tax by providing state identification numbers. It usually issued directly for the entity by the state taxing authorities.

How Do I Apply For TIN?

Individuals can obtain their tax identification number by applying to either SSA or IRS. Here are the summaries of how to apply for each type of TIN:

SSN

You have to fill out an SS-5 form or Application for a Social Security Card. It requires you to provide some information and proofs regarding your identity, your age, and your status of citizenship. This form might be obtained for free by contacting 1-800-772-1213 or directly visiting the Social Security office.

EIN

There are several different ways to apply for EIN:

- Online: Complete the EIN application via the internet through the official website of IRS and immediately gain it after the online session is finished.

- Fax: Send a completed SS-4 Form in PDF format to the fax number of IRS.

- Mail: send a completed SS-4 Form to the correct mailing address of IRS, and expect to receive your EIN in four weeks.

- Telephone: For international applicants, they may obtain EIN by dialing 267-941-1099 which’s available from 6 A.M to 11 P.M EST, Monday to Friday. The completion of the SS-4 Form is done by answering the given questions through the call.

ITIN

Complete the W7 Form which is issued by the IRS. This document requires you to provide substantial information regarding your personal identity and citizenship status. The form can be sent through the mailing option to the address informed within the W7 Form instruction; by handing it out in-person to IRS offices; or by giving it to the IRS’ Acceptance Agent.

ATIN

Complete the W7-A Form, which formally known as the Application for Taxpayer Identification Number for Pending U.S. Adoptions document. This may not be used for a child who is not a citizen or resident of the United States.

PTIN

If you are a first-time applicant for PTIN, it generally can be obtained online through the official website in approximately 15 minutes. Both the application and renewal process requires you to provide a non-refundable fee. Alternatively, you may use the W12 Form (IRS Paid Preparer Tax Identification Number Application) and wait for the process to be done in 4-6 weeks.

Do All Countries Have TIN Number?

Most of the countries use a similar system of TIN Numbers as the U.S, where the TIN can be issued to an individual or corporate entity. However, there are also some countries such as United Arab Emirates (UAE), Bahrain, and Bermuda that do not. There are also some countries that give TIN to entities only instead of individuals such as Qatar, Oman, and Sri Lanka.

Some countries use a different term for TIN with equivalent functions, such as how India refers to it as Permanent Account Number (PAN) or Hongkong calls it as Business Registration Number. The term’s functional equivalents are including resident registration numbers, national insurance numbers, personal identification, citizen number, national insurance number, and many more.

Frequently Asked Questions (FAQ) & Answers

How Do I Know My TIN Number?

The United States Taxpayer Identification Number can be located on various documents such as tax returns or other IRS-issued tax-related documents. Meanwhile, the SSN can be found in the SSA-issued social security card.

Is My TIN The Same As My SSN?

Social Security Number is technically one of the several types of TIN. It is, however, probably the most used ID number for different purposes such as to seek employment in the U.S, to gain credit from financial institutions, or to file the tax returns to the IRS.

Do US Citizens Have A TIN Number?

Yes. It may include a Social Security Number (for individuals), Employer Identification Number (for individuals or entities), an Individual Taxpayer Identification Number. TIN number but currently don’t have and aren’t eligible to obtain an SSN.

Who Is Eligible For The TIN Number?

Any U.S. taxpayer is eligible and should provide the Taxpayer Identification Number for documents filed to the IRS.

Can I Get A TIN Number Without A Job?

Employees must provide their Taxpayer Identification Number with documents as proof of their identity and work authorization in the U.S., at least three days from the beginning of employment. It is acceptable to provide receipts that show the TIN applications as well.

How Long Does It Take To Get A TIN?

In general, a paper application should take approximately 4-6 weeks to be processed. Some TIN types might take minutes to be processed if applied online such as the EIN number online application.

By now, you have read and understood more about a TIN number, and how it actually comprised several different types for identification during tax filing purposes. It can be necessary to know about their differences, whether you serve as an individual who files their tax or for purposes of identification, or an employer who runs your business and manage your employees and the employment system within your company.