2025 W2 Blank Form – # Get Ready for 2025: All About the W2 Blank Form!

Prepare for the Future: Understand the W2 Blank Form!

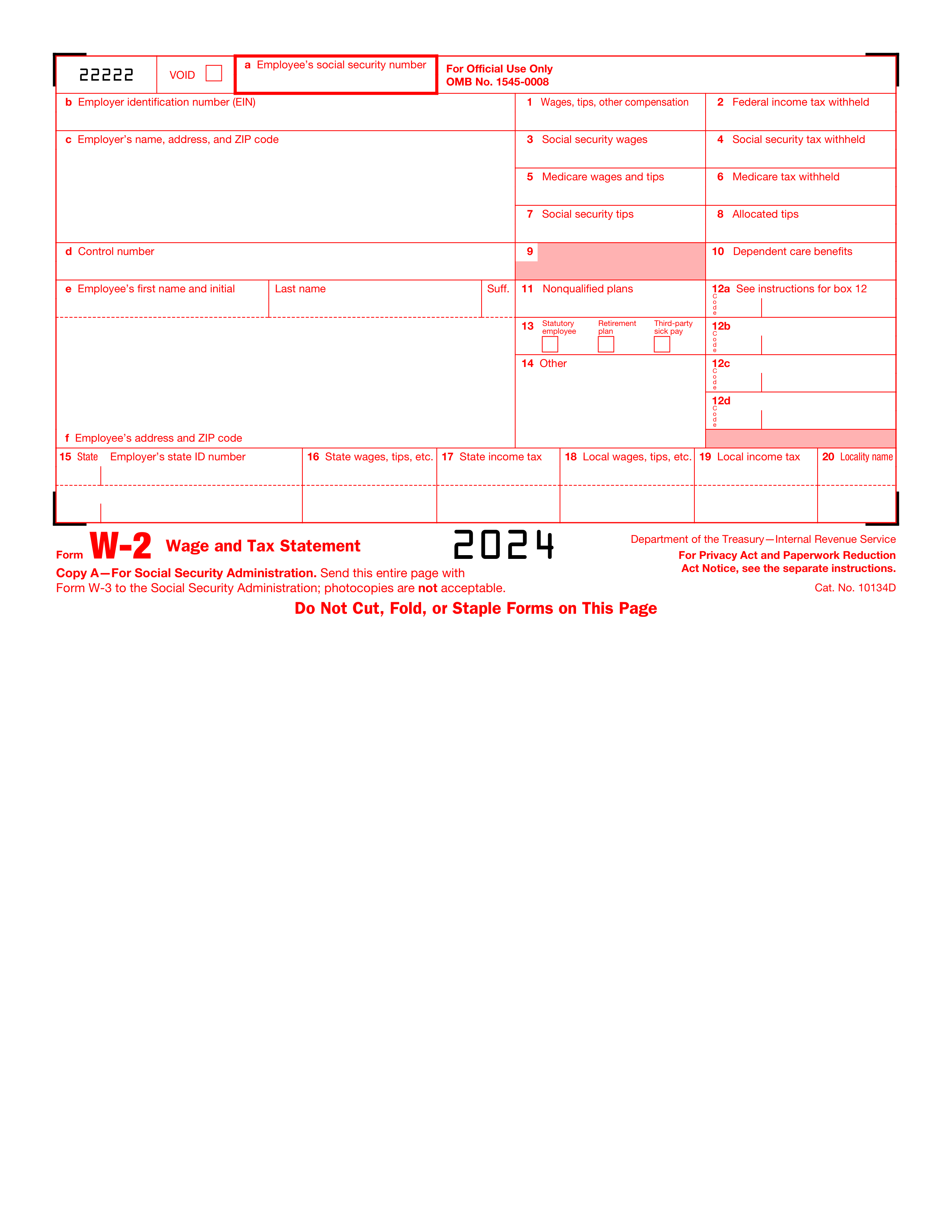

As we gear up for the year 2025, it’s essential to stay ahead of the game when it comes to understanding the W2 blank form. This crucial document is used by employers to report employee wages and salaries to the IRS, ensuring that taxes are properly withheld and reported. By familiarizing yourself with the ins and outs of the W2 form, you can streamline the tax filing process and avoid any potential errors or delays.

One key element to understand about the W2 form is that it includes important information such as your total earnings, tax withholdings, and any deductions such as retirement contributions or health insurance premiums. This form is crucial for accurately filing your taxes and ensuring that you comply with IRS regulations. By taking the time to review your W2 form thoroughly, you can catch any discrepancies early on and address them before filing your taxes.

In addition to understanding the information included on the W2 form, it’s also important to know when and how to expect to receive it. Employers are required to provide employees with their W2 forms by January 31st each year, giving you ample time to file your taxes before the deadline. If you haven’t received your W2 form by the end of January, be sure to reach out to your employer to request a copy. By staying proactive and informed, you can ensure a smooth tax filing process for the year 2025.

Get Ahead of the Game: Learn All About the W2 Form for 2025!

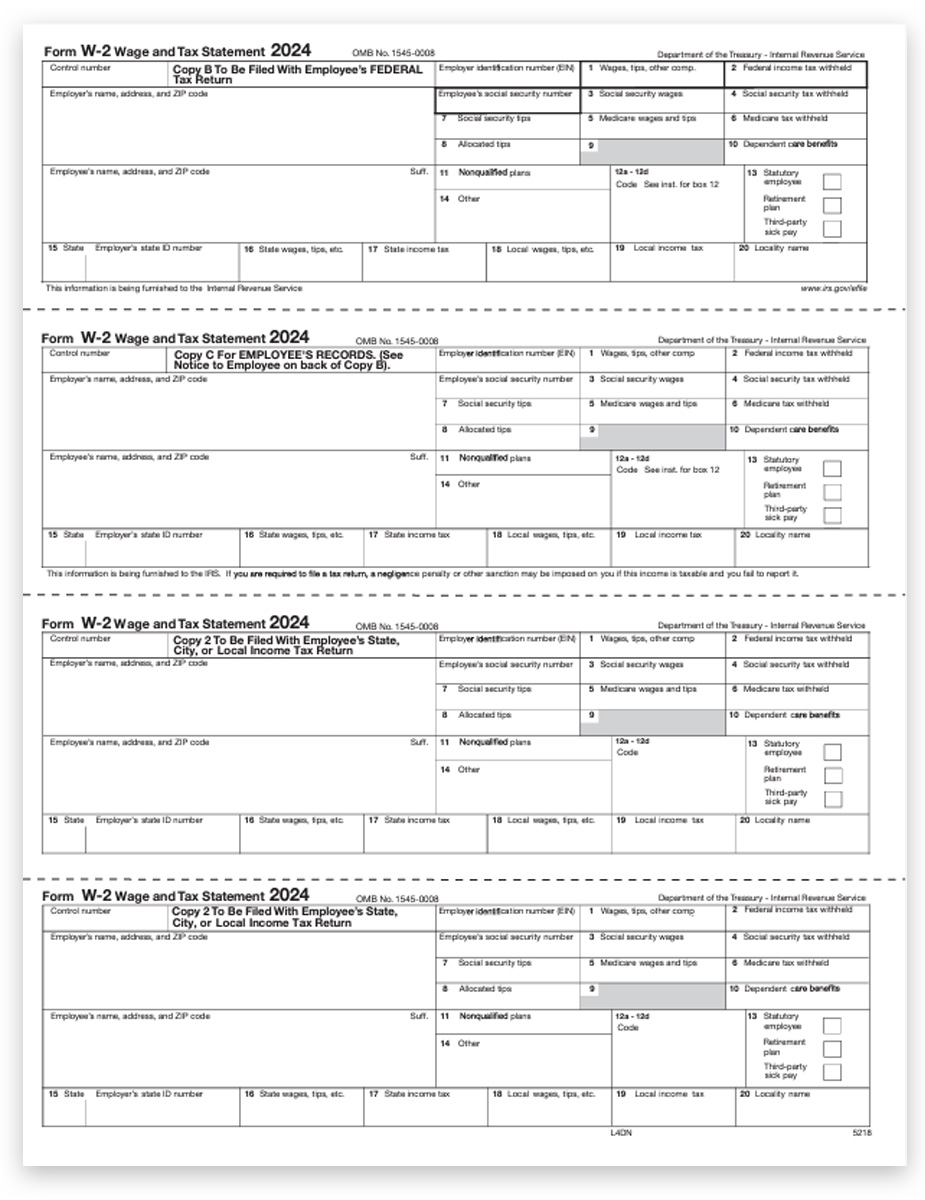

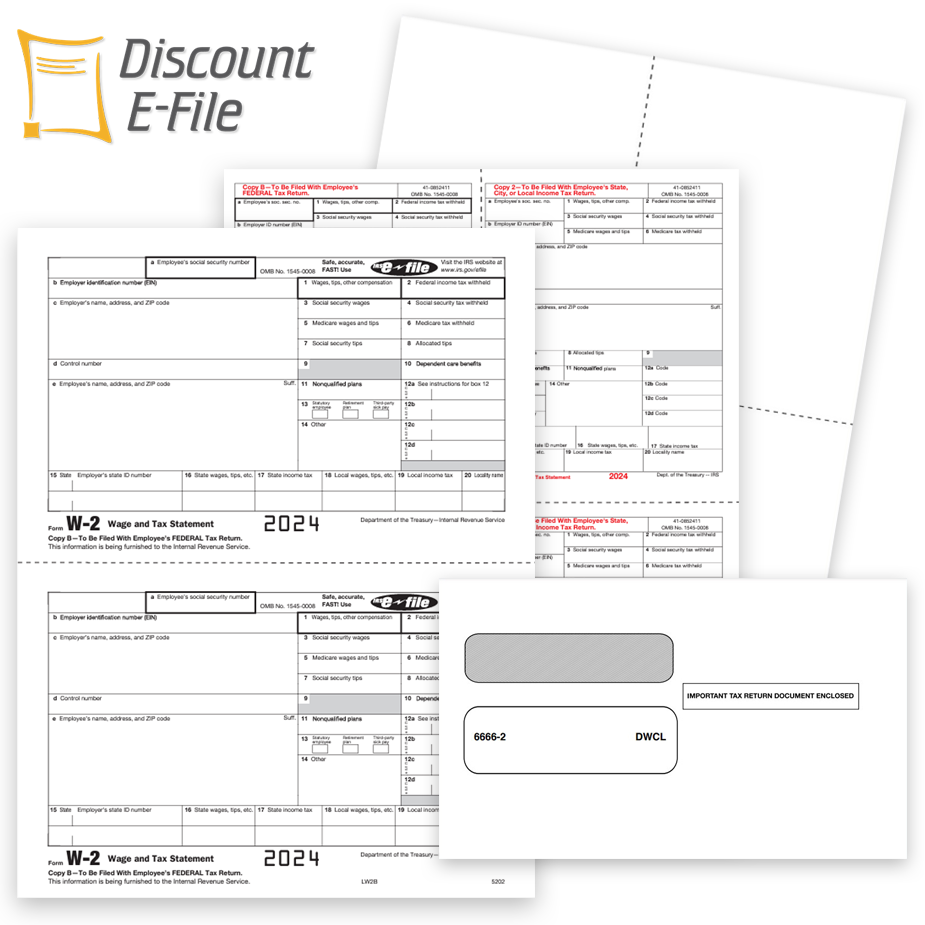

As we look ahead to 2025, now is the perfect time to familiarize yourself with the W2 form and all its intricacies. From understanding the various boxes and codes on the form to knowing how to properly report your earnings and deductions, taking the time to educate yourself can save you time and hassle when it comes to filing your taxes. By getting a head start on learning about the W2 form, you can set yourself up for success in the upcoming tax season.

One important aspect to be aware of is the importance of keeping accurate records of your income and expenses throughout the year. By maintaining organized records, you can easily cross-reference the information on your W2 form and ensure that all of your earnings and deductions are accurately reported. This can help prevent any discrepancies or issues with the IRS down the line, giving you peace of mind as you prepare for tax season.

In addition to understanding the information on the W2 form, it’s also helpful to familiarize yourself with any changes or updates to tax laws that may impact your filing. By staying informed about any new regulations or requirements, you can ensure that you are in compliance with the latest tax guidelines and avoid any potential penalties or fines. By taking the time to learn all about the W2 form for 2025, you can approach tax season with confidence and ease.

In conclusion, preparing for the future by understanding the W2 blank form is essential for a smooth and stress-free tax filing process. By taking the time to educate yourself on the ins and outs of the W2 form, you can ensure that your taxes are filed accurately and on time. Stay ahead of the game by learning all about the W2 form for 2025, and you’ll be well-equipped to tackle tax season with confidence and ease!

2025 W2 Blank Form

printable 2025 form w-2 : create, fill, and file – boomtax

boomtax.com

form w-2 – 2025 | fill and sign with lumin

imagedelivery.net

w-2 form 2024-2025: fill, edit, and download – pdf guru

pdfguru.com

w2 form irs 2025 fillable pdf | with print and clear buttons

i.etsystatic.com

w-2 form 2024-2025: fill, edit, and download – pdf guru

pdfguru.com

w2 form printable: fill out & sign online | dochub

www.pdffiller.com

form w-2, wage and tax statement for hourly & salary workers

www.efile.com

w2 tax forms, condensed 4up v2 for employees – discounttaxforms

cdn.discounttaxforms.com

trdset4i05 – traditional w-2 form 4-part set (blank copies with

cdn11.bigcommerce.com

w2 tax forms and envelopes for 2024 – discounttaxforms

cdn.discounttaxforms.com