2025 W4 Form Oregon – # Unveiling the Oregon W4 Form: Your Guide to 2025!

Tax season can be a stressful time for many, but fear not – we’re here to help you navigate the ins and outs of the Oregon W4 Form for 2025! Whether you’re a seasoned taxpayer or new to the game, this comprehensive guide will simplify the process and ensure you’re on the right track to maximizing your deductions and minimizing your liabilities. So sit back, relax, and let’s dive into the world of taxes together!

## Dive into the Oregon W4 Form for 2025!

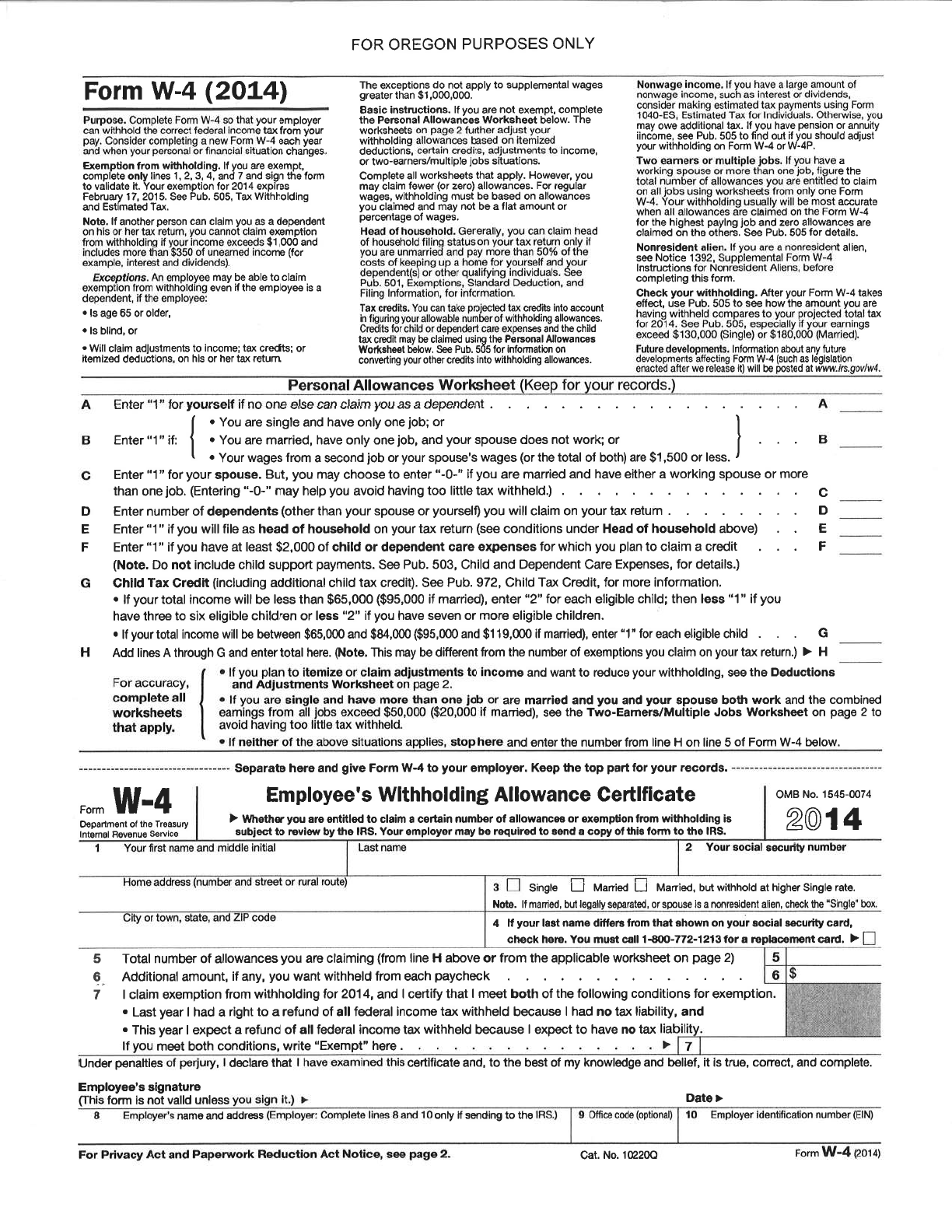

The Oregon W4 Form is a crucial document that allows your employer to withhold the correct amount of state income tax from your paycheck. It’s important to fill out this form accurately to avoid any surprises come tax season. The form will ask for information such as your filing status, number of allowances, and any additional withholding you’d like to specify. By understanding how to properly fill out this form, you can ensure that you’re not overpaying or underpaying your state income tax throughout the year.

One key aspect of the Oregon W4 Form is determining your filing status. This can vary depending on your personal situation, such as whether you’re single, married, or head of household. Your filing status will impact how much state income tax is withheld from your paycheck. It’s important to review this section carefully and choose the status that best reflects your current circumstances. By selecting the appropriate filing status, you can ensure that you’re paying the correct amount of state income tax and avoiding any potential penalties or interest on underpayments.

Another important factor to consider when filling out the Oregon W4 Form is the number of allowances you claim. This number reflects how many tax exemptions you’re claiming, which can impact the amount of state income tax withheld from your paycheck. The more allowances you claim, the less tax will be withheld, and vice versa. It’s important to review your financial situation and consult with a tax professional if needed to determine the appropriate number of allowances to claim. By getting this number right, you can ensure that you’re not overpaying or underpaying your state income tax and maximize your take-home pay.

## Simplify Your Tax Season with This Comprehensive Guide!

In addition to the basic sections of the Oregon W4 Form, there may be additional considerations to keep in mind. For example, if you have multiple jobs or sources of income, you may need to adjust your withholding allowances to avoid underpayment at the end of the year. It’s important to review your financial situation regularly and make any necessary updates to your W4 Form to ensure that you’re on track with your tax obligations. By staying proactive and informed, you can simplify your tax season and avoid any potential headaches down the road.

As you dive into the Oregon W4 Form for 2025, remember that there are resources available to help you along the way. Whether it’s consulting with a tax professional, using online tools and calculators, or reaching out to the Oregon Department of Revenue for guidance, don’t be afraid to ask for help if needed. Taxes can be complex, but with the right knowledge and support, you can navigate the process with confidence and peace of mind. So take a deep breath, gather your documents, and let’s make this tax season a breeze together!

In conclusion, understanding the Oregon W4 Form for 2025 is key to ensuring that you’re on the right track with your state income tax obligations. By diving into the details of this form, considering your filing status, allowances, and any additional withholding, you can simplify your tax season and avoid any surprises come tax time. Remember to stay informed, seek help when needed, and be proactive in managing your tax obligations. With this comprehensive guide in hand, you’ll be well-equipped to tackle tax season like a pro. Happy filing!

2025 W4 Form Oregon

2025 form or-w-4, oregon withholding, 150-101-402

fillable online forms uoregon w-4-oregon-withholding-instructions

www.pdffiller.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

oregon form w4p: fill out & sign online | dochub

www.pdffiller.com

oregon paycheck calculator: formula to calculate net income

factorialhr.com

2018-2025 form or or-wr fill online, printable, fillable, blank

www.pdffiller.com

state w-4 form | detailed withholding formsstate chart (2025)

www.patriotsoftware.com

oregon paycheck calculator: formula to calculate net income

factorialhr.com

free oregon form w-4 (2014) – pdf | 341kb | 1 page(s)

www.speedytemplate.com

w4 tax form | w-4 tax form. required steps 1 & 5

i.ytimg.com