2025 W4 IRS Form – # Get Ready for Tax Season 2025 with the New W4 Form!

Say Goodbye to Confusion: Introducing the Updated W4 Form for Tax Season 2025!

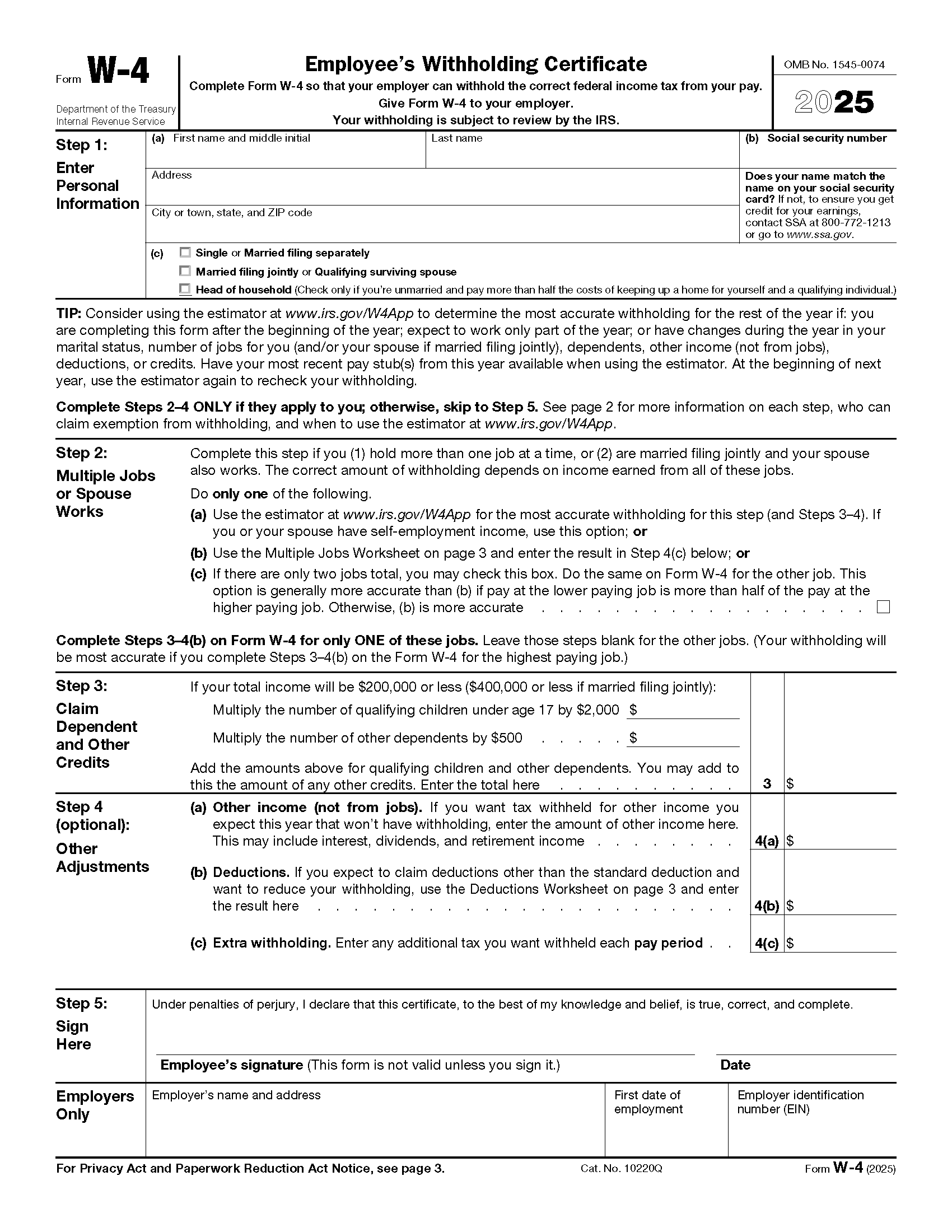

Tax season can often be a stressful time, with confusing forms and complex calculations. But fear not, because the IRS has revamped the W4 form for the 2025 tax season to make things easier than ever before! The updated form aims to simplify the process of calculating withholding allowances, making it more user-friendly and less prone to errors. With clear instructions and straightforward questions, you can say goodbye to confusion and hello to a smoother tax filing experience.

One of the key changes in the new W4 form is the removal of the complicated withholding allowances system. Instead of trying to calculate allowances based on personal exemptions and deductions, the new form focuses on straightforward questions about your filing status and income. This shift towards simplicity will not only make it easier for taxpayers to fill out the form accurately, but it will also help ensure that the correct amount of tax is withheld throughout the year. So, get ready to breeze through tax season with the updated W4 form in hand!

With the new W4 form for the 2025 tax season, taxpayers can look forward to a more efficient and stress-free filing process. By taking the time to familiarize yourself with the changes and understand how they affect your withholding, you can avoid any last-minute surprises come tax time. So, embrace the updated form, leave confusion behind, and get ready to tackle tax season with confidence!

Get Ahead of the Game: Tips and Tricks for Navigating the New W4 Form with Ease!

As you prepare to tackle the new W4 form for the 2025 tax season, there are a few tips and tricks that can help you navigate it with ease. First and foremost, take the time to read through the instructions carefully and make sure you understand each question before providing a response. This will help ensure that you provide accurate information and avoid any potential errors in your withholding calculations.

Another helpful tip for filling out the new W4 form is to use the IRS’s online withholding calculator. This tool can help you determine the correct amount of tax to withhold based on your specific financial situation. By inputting accurate information about your income, deductions, and credits, you can get a more precise estimate of your withholding and make any necessary adjustments to avoid under or over withholding.

Lastly, don’t be afraid to ask for help if you need it. Whether you reach out to a tax professional or utilize the resources provided by the IRS, getting assistance with filling out the new W4 form can help ensure that you are on the right track. By staying proactive and seeking guidance when needed, you can navigate the tax season with confidence and ease.

In conclusion, the updated W4 form for the 2025 tax season is here to make your life easier when it comes to filing your taxes. With its simplified format and user-friendly design, you can say goodbye to confusion and hello to a smoother tax filing experience. By following the tips and tricks provided, you can navigate the new form with ease and get ahead of the game this tax season. So, embrace the changes, stay proactive, and get ready to tackle tax season 2025 like a pro!

2025 W4 IRS Form

2025 form w-4r

irs form w-4 walkthrough, employee's withholding certificate (2025)

i.ytimg.com

free irs form w4 (2024) – pdf – eforms

eforms.com

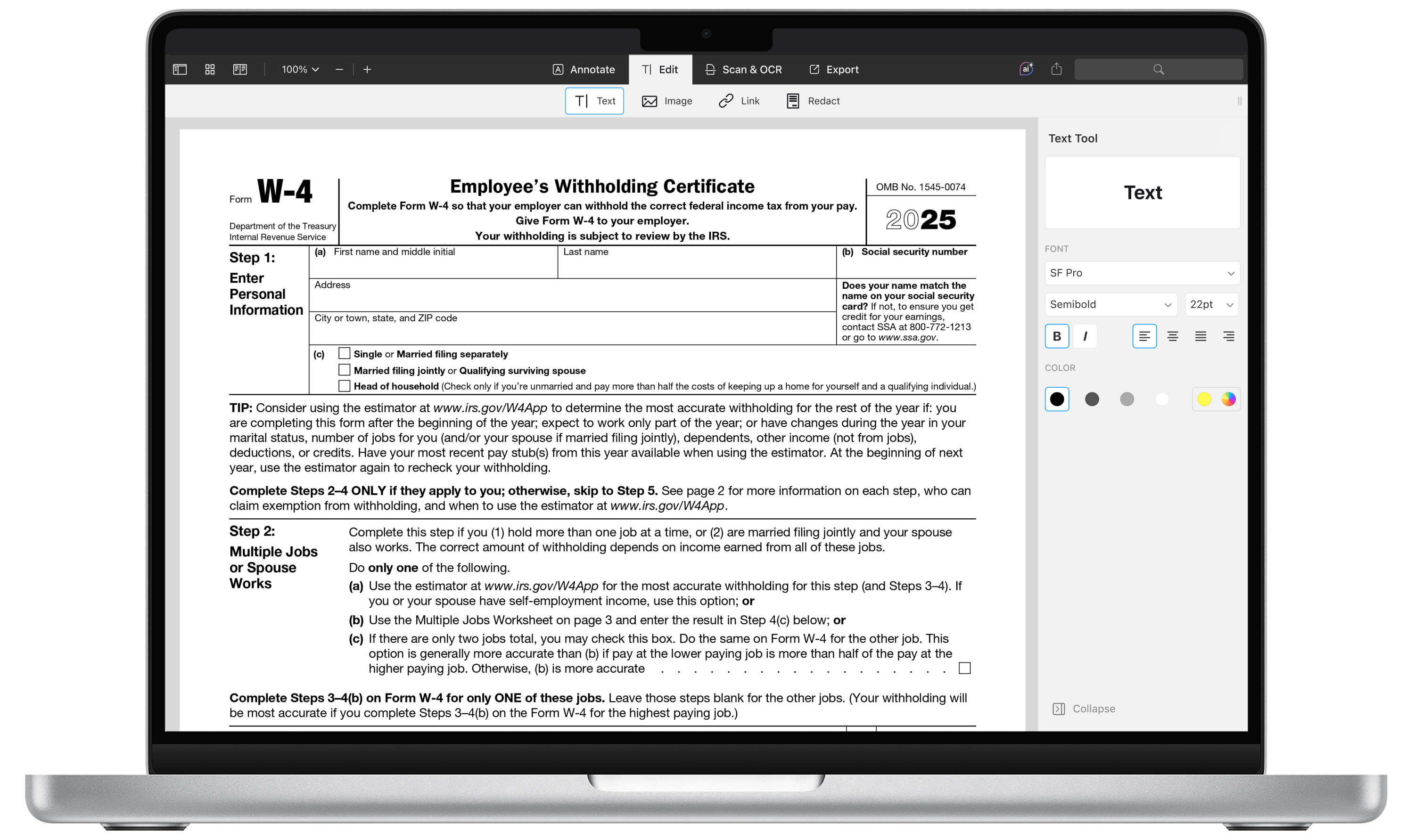

das irs-formular w4 für 2025 als pdf ausfüllen | pdf expert

cdn-rdstaticassets.readdle.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

🚨🚨attention w-2 earners!🚨🚨 if you receive a w-2, i strongly

lookaside.instagram.com

2018-2025 form irs w-4v fill online, printable, fillable, blank

www.pdffiller.com

the 2025 w4: where to find it, how it works and what you'll need. #greenscreen #w4 #taxes #w4form #2025w4 #mrandmrssmith

www.tiktok.com

how to complete the 2025 w-4 form: a simple guide for household

54123.fs1.hubspotusercontent-na1.net