W4 2025 Form Spanish – # ¡Hola! Get Ready for the All-New W4 2025 Form Spanish

Are you ready to say goodbye to the old and hello to the new? Get excited because the all-new W4 2025 Form Spanish is here to revolutionize the way you fill out your tax forms. Say adiós to confusion and hola to simplicity with this user-friendly and innovative update. Get ready to embark on a new era of tax form completion that will make your life easier than ever before.

Say goodbye to language barriers with the all-new W4 2025 Form Spanish. This exciting update ensures that Spanish-speaking individuals can easily navigate through the form without any confusion. From basic personal information to detailed tax calculations, everything is now available in Spanish, making the process smoother and more accessible for all. No more struggling to understand complex tax terminology – with the W4 2025 Form Spanish, everything is clear and concise.

But that’s not all – the W4 2025 Form Spanish also comes equipped with exciting new features that will make filling out your tax forms a breeze. With interactive tools and helpful tips built into the form, you can now easily calculate deductions, credits, and more with just a few clicks. Say goodbye to the days of endless calculations and confusion – the W4 2025 Form Spanish is here to simplify your tax filing experience and save you time and stress.

# Discover the Exciting Features of the W4 2025 Form Spanish

Get ready to experience a whole new level of convenience with the W4 2025 Form Spanish. This innovative update not only provides a seamless experience for Spanish speakers but also offers a range of exciting features that will truly revolutionize the way you approach tax filing. From personalized guidance to real-time updates, the W4 2025 Form Spanish has everything you need to make the process smooth and stress-free.

One of the most exciting features of the W4 2025 Form Spanish is its personalized guidance tool. This tool provides tailored suggestions and recommendations based on your individual tax situation, helping you maximize your deductions and credits. With just a few simple questions, you can receive personalized advice that will help you make the most of your tax return and ensure you’re getting the best possible outcome. Say goodbye to guesswork – with the W4 2025 Form Spanish, you’ll have all the support you need to file with confidence.

In addition to personalized guidance, the W4 2025 Form Spanish also offers real-time updates and reminders to keep you on track throughout the filing process. With notifications for upcoming deadlines, missing information, and more, you can rest assured that you’ll never miss a beat when it comes to your taxes. Stay organized, informed, and in control with the W4 2025 Form Spanish, the ultimate tool for stress-free tax filing.

In conclusion, the all-new W4 2025 Form Spanish is a game-changer for tax filers everywhere. With its user-friendly interface, comprehensive Spanish language support, and innovative features, this update is set to make tax season a breeze for everyone. Say goodbye to confusion and hello to simplicity with the W4 2025 Form Spanish – your one-stop solution for stress-free tax filing. Get ready to experience a whole new level of convenience and efficiency with this exciting update. ¡Hasta luego, old tax forms – hola, W4 2025 Form Spanish!

W4 2025 Form Spanish

certificado de retenciones del empleado

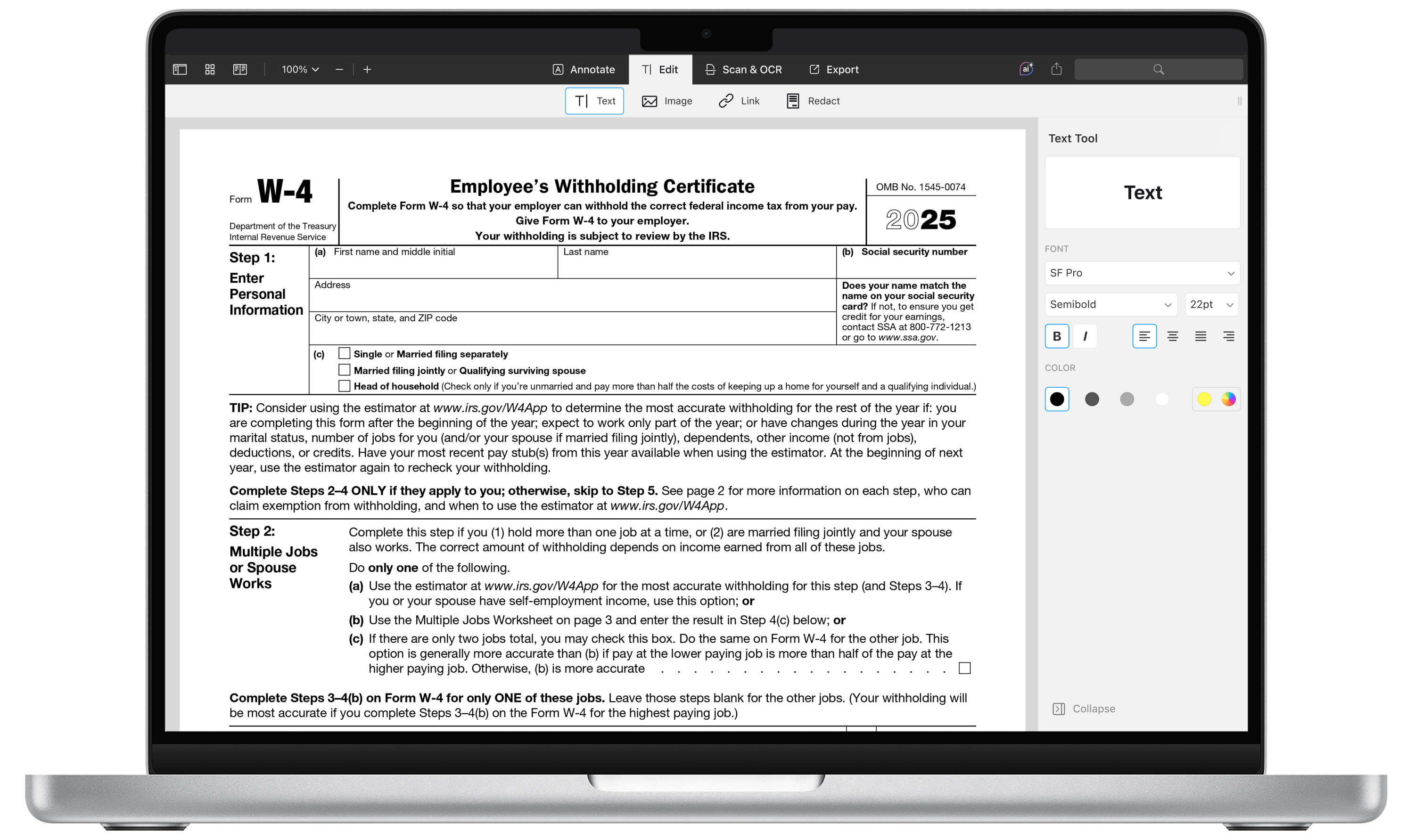

das irs-formular w4 für 2025 als pdf ausfüllen | pdf expert

cdn-rdstaticassets.readdle.com

tax help – w4 – spanish

i.ytimg.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

das irs-formular w4 für 2025 als pdf ausfüllen | pdf expert

cdn-rdstaticassets.readdle.com

2023-2025 form ct drs ct-w4 fill online, printable, fillable

www.pdffiller.com

¿cómo completo el formulario w-4? | tutorial

i.ytimg.com

how to fill out the w4 form if married and both work? | updf

updf.com

irs form 1040-es instructions – estimated tax payments

i.ytimg.com

the 2025 w4 form example: married filing jointly, both working jobs, making $150,000 combined, 0 kids (((part two: how to avoid owing))) follow & like for part ll

www.tiktok.com