Employer Federal Withholding Tax Table 2025 – # Tax Time Travels: Your Guide to the 2025 Employer Withholding Table

Are you ready to embark on a journey through time with the 2025 Employer Withholding Table? Get ready to navigate the twists and turns of tax season with ease as you master your employer withholding for the upcoming year. With the right knowledge and tools, you can make tax time a breeze and ensure that you’re prepared for any changes that may come your way.

## Embark on a Journey through Time with the 2025 Employer Withholding Table!

Step into your time machine and prepare to travel to the year 2025 with the latest employer withholding table. This invaluable resource will help you calculate the correct amount of tax to withhold from your employees’ paychecks, ensuring that you stay compliant with all tax laws and regulations. By familiarizing yourself with this table, you can avoid any potential pitfalls and make sure that your employees are taken care of when it comes to their tax obligations.

The 2025 Employer Withholding Table is your ticket to success this tax season. By understanding how to use this tool effectively, you can streamline your payroll process and eliminate any guesswork when it comes to withholding taxes. With clear guidelines and easy-to-follow instructions, you’ll be able to navigate the complexities of tax time with confidence and accuracy, ensuring that you and your employees are in good standing with the IRS.

## Navigate the Tax Time Travels and Master Your Employer Withholding for 2025!

As you navigate the tax time travels of 2025, be sure to keep a close eye on any updates or changes to the employer withholding table. Stay informed and up-to-date on the latest tax laws and regulations, so you can make any necessary adjustments to your withholding practices. By staying proactive and informed, you can avoid any surprises come tax season and ensure that your business is operating in full compliance with all tax requirements.

Mastering your employer withholding for 2025 is essential for the success of your business and the financial well-being of your employees. By taking the time to understand the ins and outs of the employer withholding table, you can make sure that you’re meeting all of your tax obligations and keeping your payroll process running smoothly. So buckle up, get ready to travel through time, and make 2025 your best tax year yet!

In conclusion, the 2025 Employer Withholding Table is your key to a successful and stress-free tax season. By taking the time to familiarize yourself with this essential resource, you can ensure that your business is in compliance with all tax laws and regulations. So don’t wait any longer – start your tax time travels today and master your employer withholding for 2025!

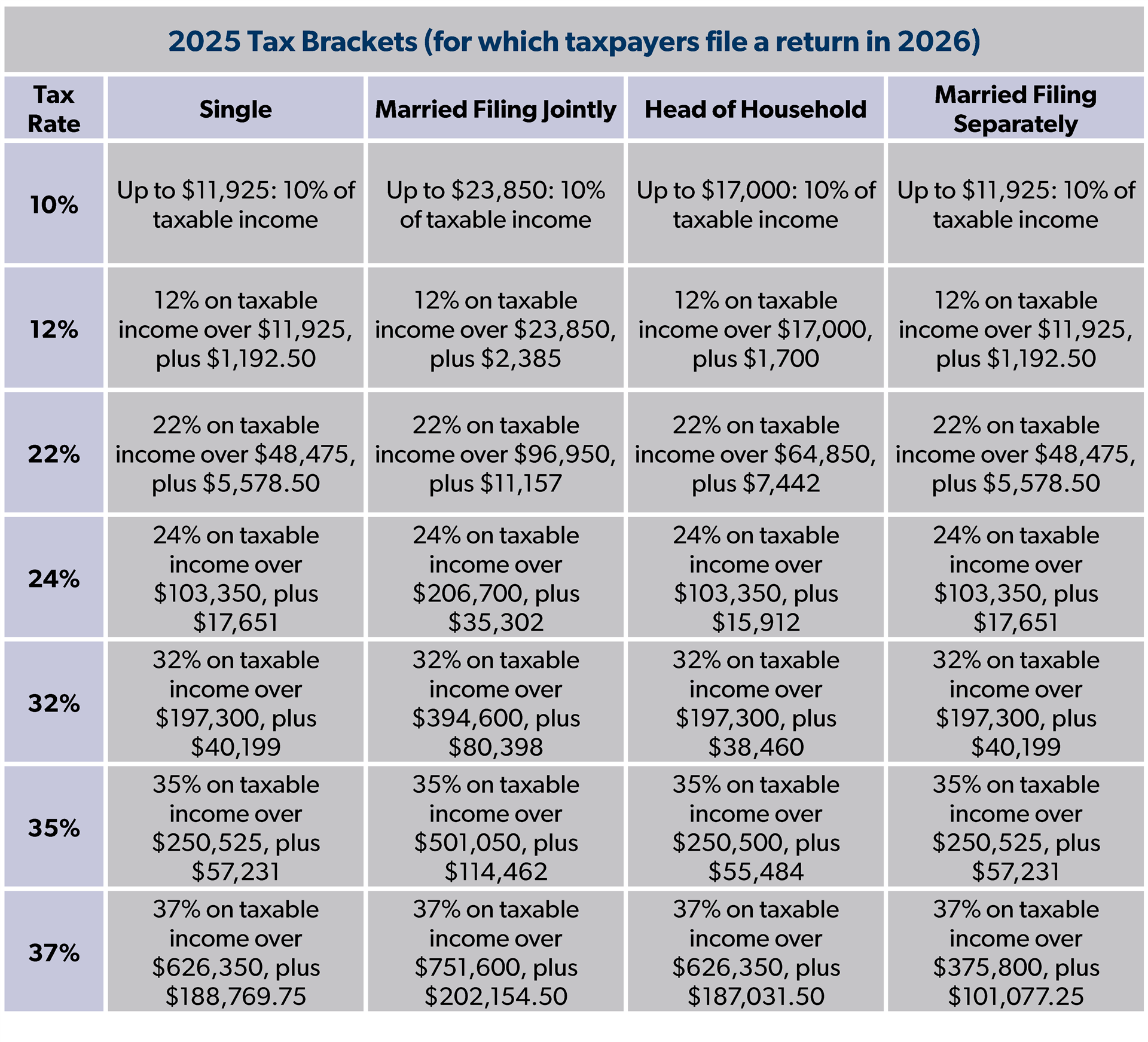

Employer Federal Withholding Tax Table 2025

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

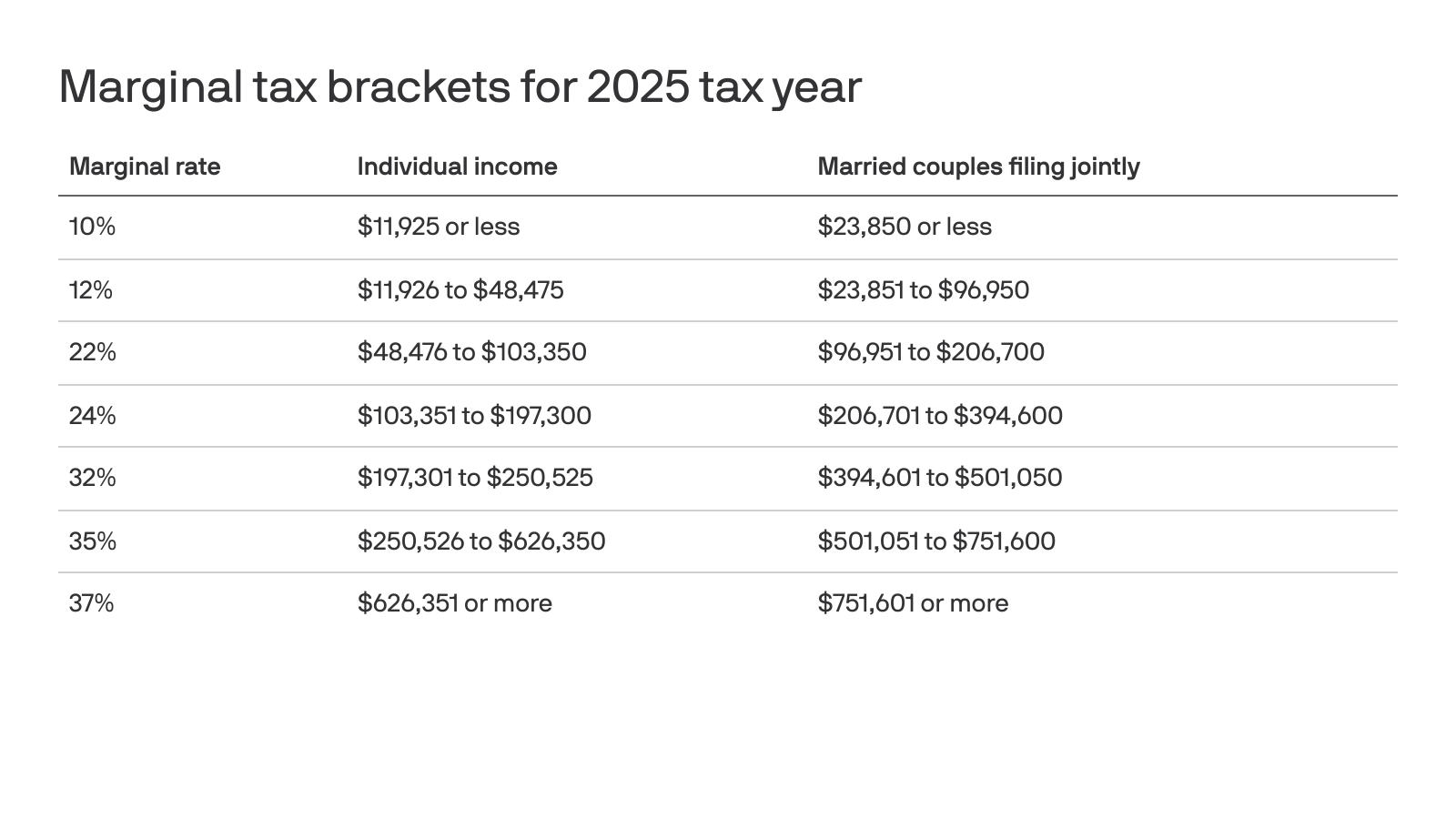

new federal income tax brackets for 2025

image.cnbcfm.com

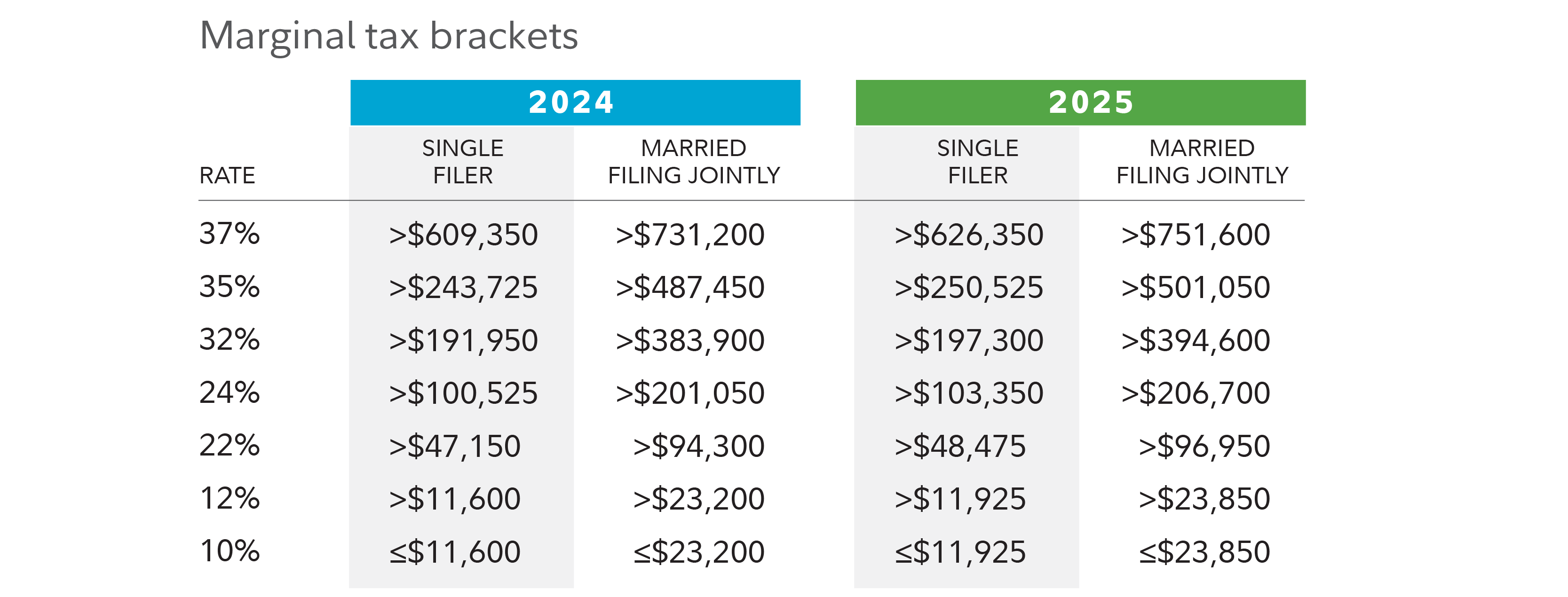

what are federal income tax rates for 2024 and 2025? – foundation

www.ntu.org

federal income tax withholding tables for 2025: a guide

www.patriotsoftware.com

2025 tax brackets: irs releases inflation adjustments, standard

images.axios.com

federal income tax brackets and irs tax tables for 2025

thecollegeinvestor.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

tax brackets 2025 | planning for tax cuts | fidelity

www.fidelity.com

2025 publication 15-t

irs form w-4r instructions – nonperiodic payments and rollovers

www.teachmepersonalfinance.com