Federal Wage Withholding Table 2025 – # Unleash Your Excitement: Your Handbook to 2025 Federal Wage Withholding!

Are you ready to dive into the world of federal wage withholding in 2025? Get your pens and highlighters ready because we are about to embark on a journey to unravel the mysteries of tax deductions and withholdings. Whether you’re a seasoned professional or a fresh-faced newbie, this guide will equip you with all the knowledge and tools you need to navigate the complex world of federal wage withholding with ease and confidence. So, buckle up and get ready to unleash your excitement for an epic adventure into the world of payroll deductions!

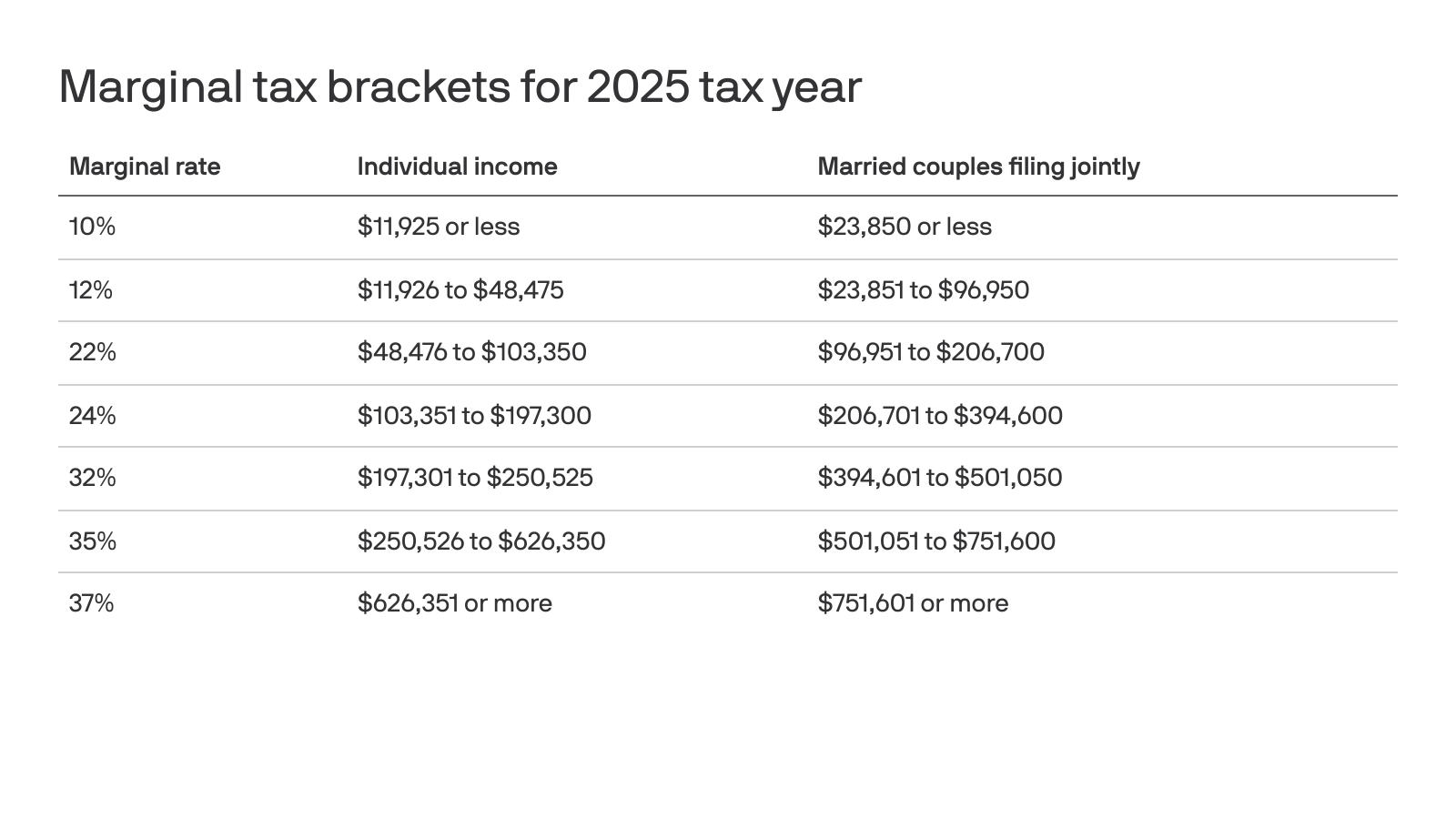

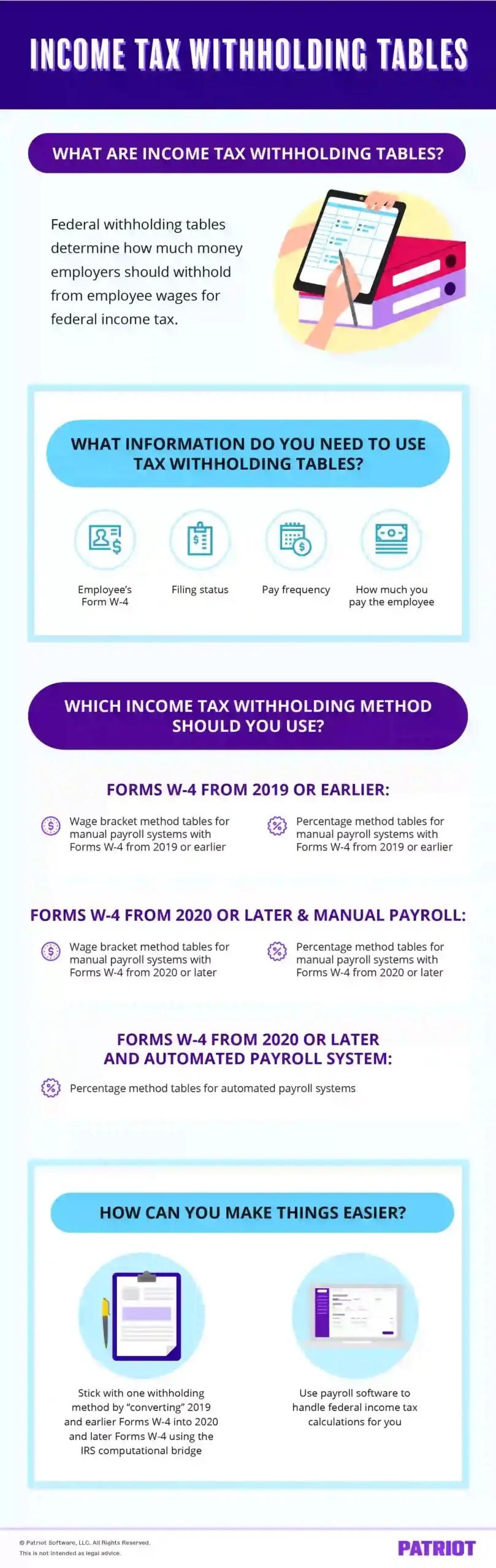

To kick things off, let’s start by understanding the basics of federal wage withholding. In simple terms, federal wage withholding is the amount of money that your employer deducts from your paycheck to cover your federal income taxes. This deduction is based on your filing status, number of allowances, and taxable income. The IRS provides employers with withholding tables to determine how much to withhold from each employee’s paycheck. By familiarizing yourself with these tables and understanding how they work, you can ensure that the right amount is being withheld from your paycheck each pay period.

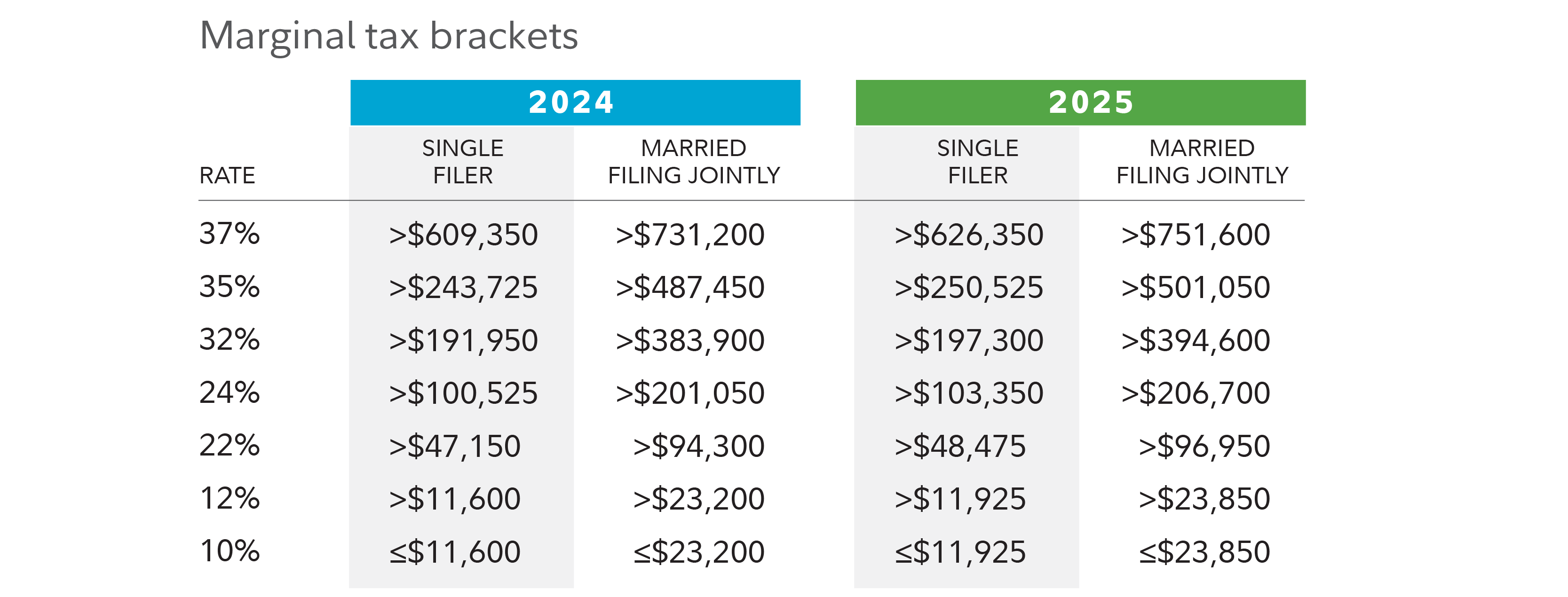

As we gear up for 2025, it’s important to stay informed about any changes or updates to federal wage withholding regulations. The tax landscape is constantly evolving, and staying up-to-date with the latest information can help you avoid any surprises come tax season. Keep an eye out for any new legislation or updates from the IRS that may impact federal wage withholding in the upcoming year. By staying informed and proactive, you can ensure that you are prepared to conquer 2025 with confidence and peace of mind when it comes to your federal tax withholdings.

# Get Ready to Conquer 2025: A Comprehensive Guide to Federal Wage Withholding!

As we look ahead to 2025, it’s essential to familiarize yourself with the ins and outs of federal wage withholding to ensure that you are in control of your finances and well-prepared for tax season. One key aspect to consider is your filing status, as this will determine how much tax is withheld from your paycheck. Whether you are single, married, or head of household, understanding your filing status and how it affects your tax withholding is crucial for accurate and efficient tax planning.

In addition to filing status, the number of allowances you claim on your W-4 form also plays a significant role in determining your federal wage withholding. By carefully assessing your financial situation and personal circumstances, you can determine the appropriate number of allowances to claim to ensure that the right amount of tax is withheld from your paycheck each pay period. Remember, it’s important to review and update your W-4 form regularly to reflect any changes in your financial situation or personal life that may impact your tax withholding.

In conclusion, 2025 is shaping up to be an exciting year for federal wage withholding, and with the right knowledge and preparation, you can conquer the world of tax deductions with confidence and ease. By familiarizing yourself with the basics of federal wage withholding, staying informed about any changes or updates to tax regulations, and assessing your filing status and allowances, you can navigate the complex world of tax deductions like a pro. So, get ready to unleash your excitement and conquer 2025 with your newfound knowledge and expertise in federal wage withholding!

Federal Wage Withholding Table 2025

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

2025 tax brackets: irs releases inflation adjustments, standard

images.axios.com

federal income tax brackets and irs tax tables for 2025

thecollegeinvestor.com

tax brackets 2025 | planning for tax cuts | fidelity

www.fidelity.com

the irs just released its inflation-adjusted tax brackets for 2025

lookaside.instagram.com

federal income tax withholding tables for 2025: a guide

www.patriotsoftware.com

single filer 2025 tax brackets just dropped and tik tok is

i.redd.it

irs announces new federal income tax brackets for 2025 – nbc 5

image.cnbcfm.com

2025 publication 15-t

2025 form w-4r