Federal Withhold Tax Table 2025 –

Let’s Get Prepared: 2025 Federal Withholding Tax Table Guide

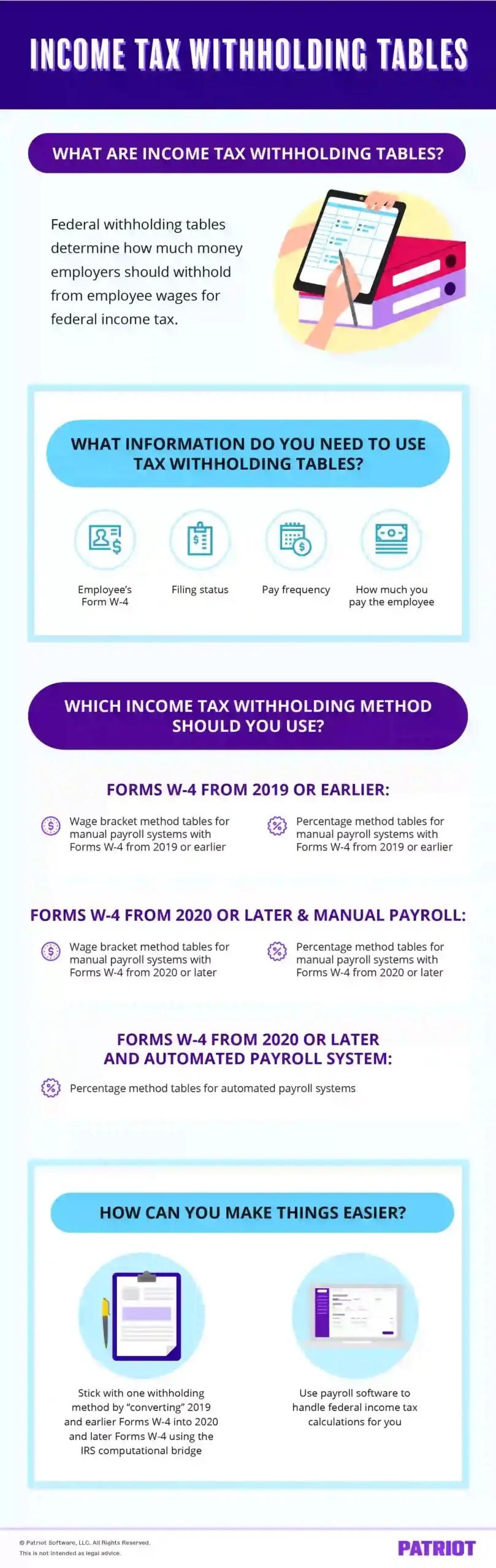

Are you ready to tackle your taxes like a pro in 2025? The key to success lies in understanding the updated Federal Withholding Tax Table. This table outlines the amount that employers must withhold from employees’ paychecks to cover federal income tax. By familiarizing yourself with this table, you can ensure that the correct amount is deducted from your paycheck each pay period. This will help you avoid any surprises when tax season rolls around.

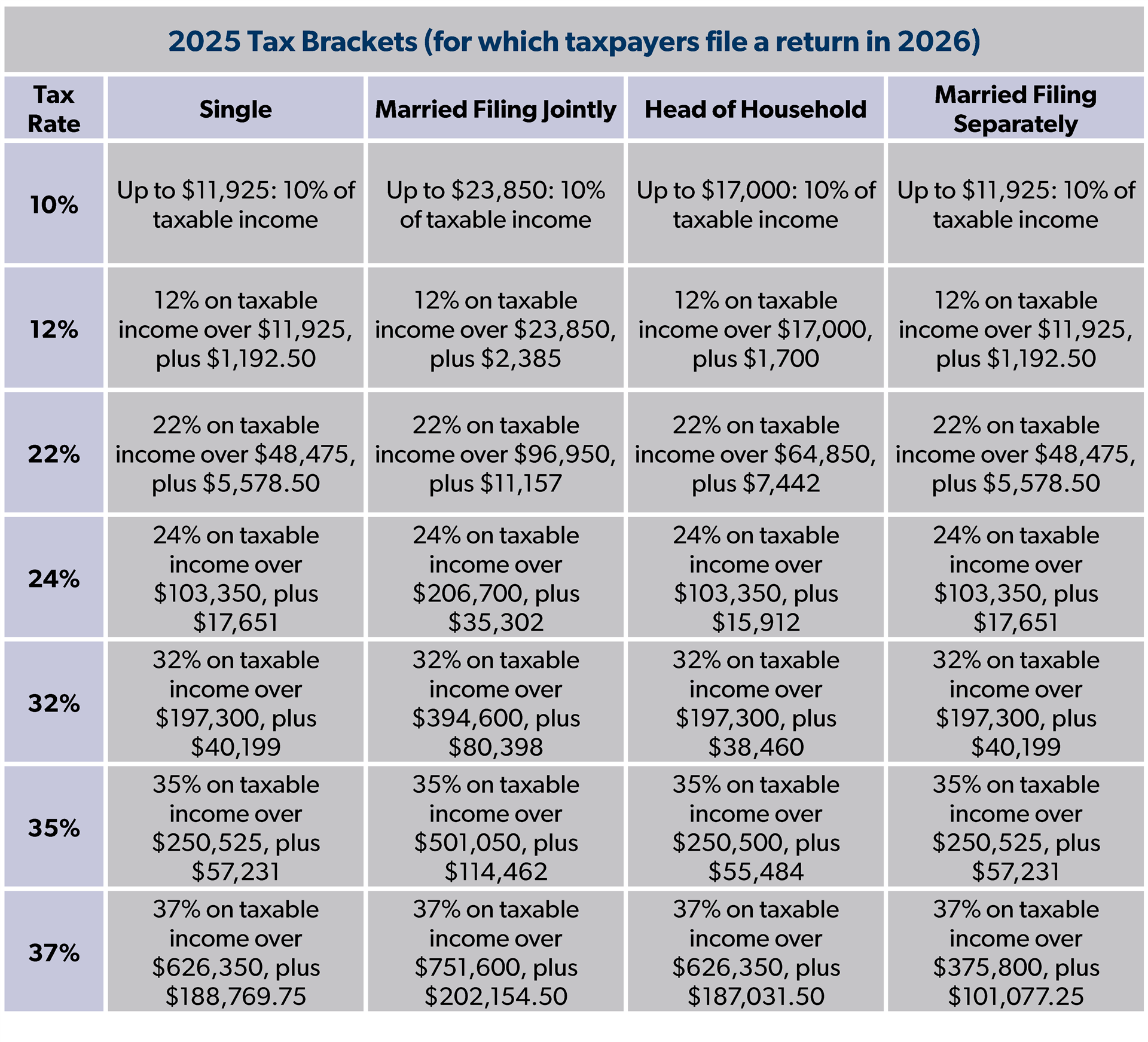

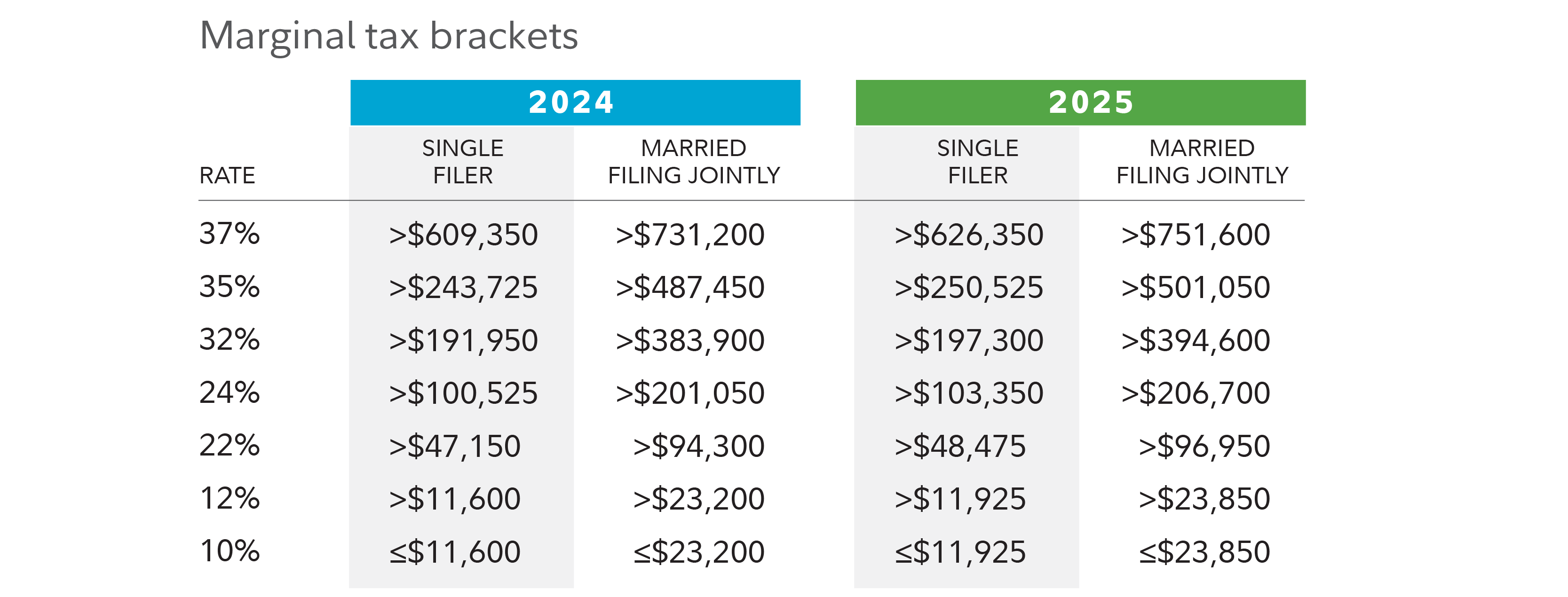

In the 2025 Federal Withholding Tax Table, you will find various tax brackets based on your filing status and income level. By knowing which bracket you fall into, you can accurately calculate how much tax should be withheld from your paycheck. It’s essential to stay informed about any changes to the tax table each year, as adjustments are made to account for inflation and other factors. By staying on top of these changes, you can avoid underpaying or overpaying your taxes throughout the year.

In addition to understanding the Federal Withholding Tax Table, it’s also crucial to take advantage of any available tax credits and deductions. By maximizing your savings through strategic tax planning, you can potentially reduce the amount of tax that is withheld from your paycheck. This extra money can then be put towards savings, investments, or other financial goals. By being proactive and informed about your tax obligations, you can set yourself up for financial success in the year 2025 and beyond.

Maximize Your Savings: Plan Ahead for 2025 Tax Changes

As you prepare for the 2025 tax year, it’s never too early to start planning ahead. By taking the time to review the Federal Withholding Tax Table and understand how it applies to your individual situation, you can make informed decisions that will benefit you in the long run. Consider consulting with a tax professional to ensure that you are taking full advantage of any available tax breaks and credits. By maximizing your tax savings, you can keep more of your hard-earned money in your pocket.

One way to plan ahead for the 2025 tax changes is to review your current financial situation and make any necessary adjustments. This may include increasing your retirement contributions, setting up a health savings account, or exploring other tax-advantaged savings options. By taking a proactive approach to your finances, you can ensure that you are prepared for any tax changes that may come your way in the future. Remember, it’s never too early to start planning for the year ahead.

In conclusion, the 2025 Federal Withholding Tax Table is a valuable tool that can help you navigate the complexities of the tax system. By understanding how this table works and planning ahead for any tax changes, you can set yourself up for financial success in the year 2025. Remember to stay informed, take advantage of available tax credits and deductions, and consult with a tax professional if needed. With a little preparation and a positive attitude, you can tackle your taxes with confidence and maximize your savings in the year ahead.

Federal Withhold Tax Table 2025

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

what are federal income tax rates for 2024 and 2025? – foundation

www.ntu.org

federal income tax brackets and irs tax tables for 2025

thecollegeinvestor.com

single filer 2025 tax brackets just dropped and tik tok is

i.redd.it

federal income tax withholding tables for 2025: a guide

www.patriotsoftware.com

2025 form w-4r

income purchases 2025 tax estimator

datawrapper.dwcdn.net

2025 tax brackets and federal income rates

image.cnbcfm.com

the irs has released the tax brackets and rates for 2025, and it's

lookaside.instagram.com

tax brackets 2025 | planning for tax cuts | fidelity

www.fidelity.com