Federal Withholding Tax Table 2025 Married Jointly – # Maximize Your Refund: 2025 Married Joint Federal Tax Withholding Table

Are you ready to turbocharge your tax refund in 2025? One of the most powerful ways to boost your refund is by taking advantage of the married joint federal tax withholding table. By filing jointly with your spouse, you can optimize your tax situation and potentially qualify for a larger refund. With the latest updates and tips for maximizing your tax refund, you can unlock the full potential of joint filing and enjoy some extra cash in your pocket come tax season.

## Unleash the Power of Joint Filing: 2025 Tax Withholding Table

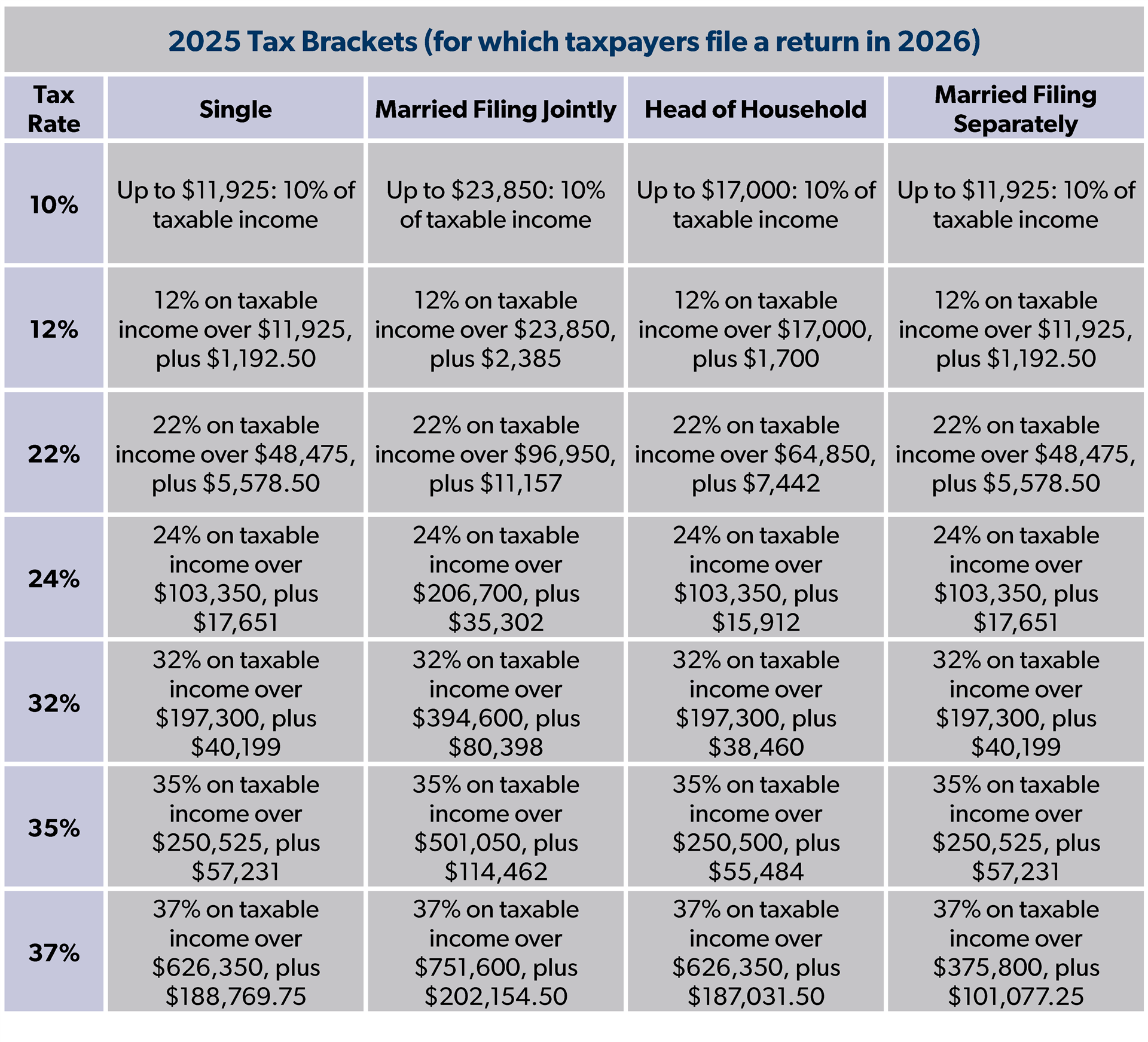

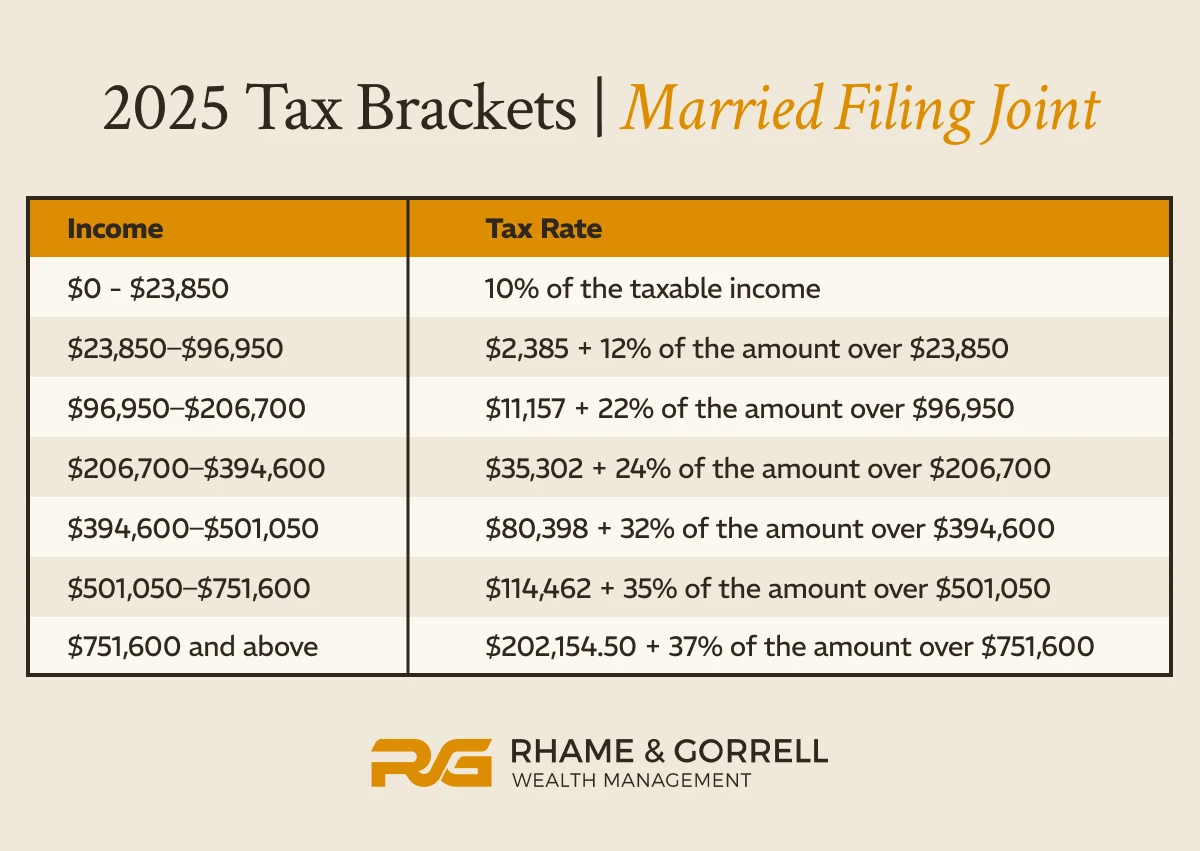

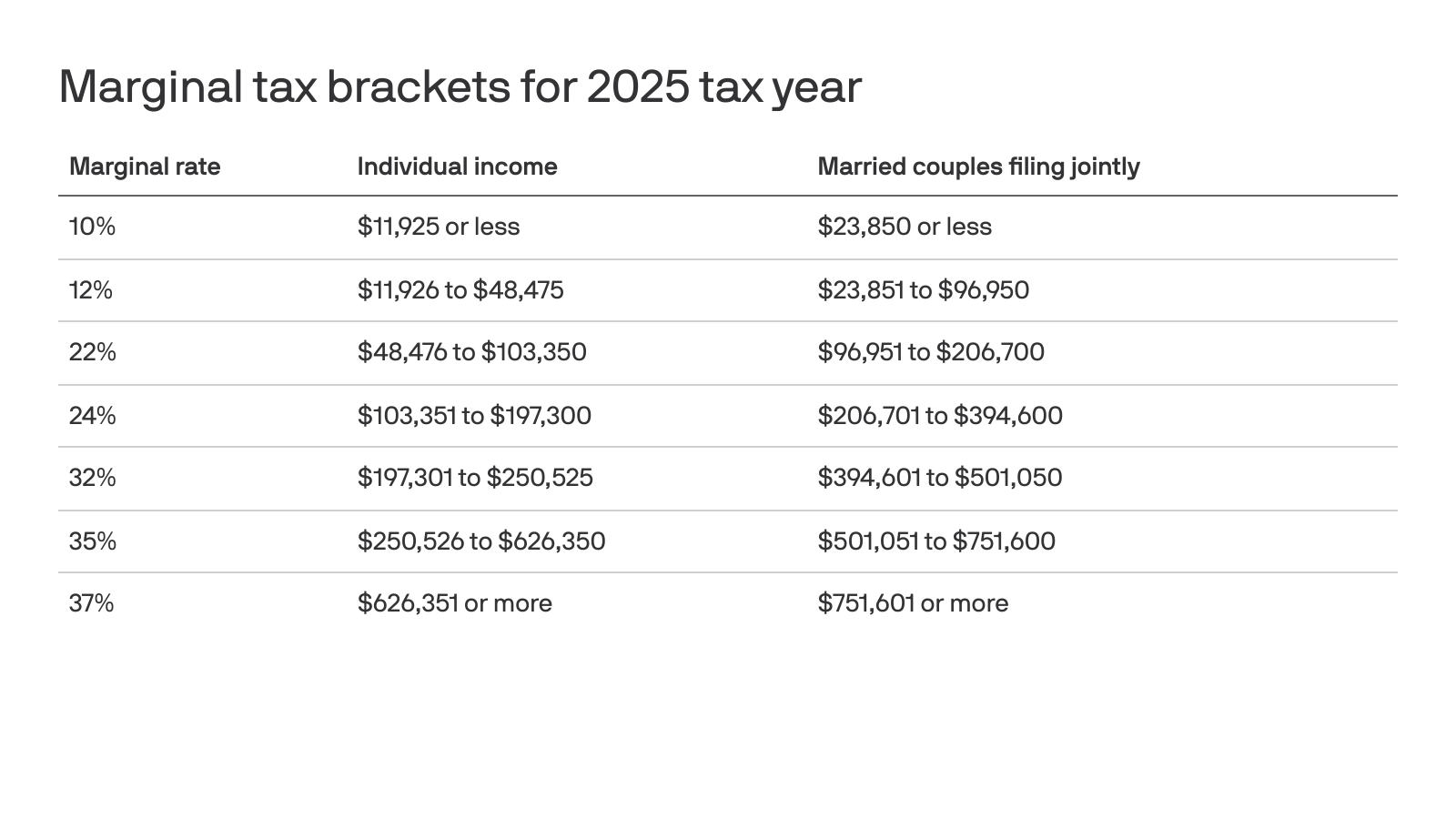

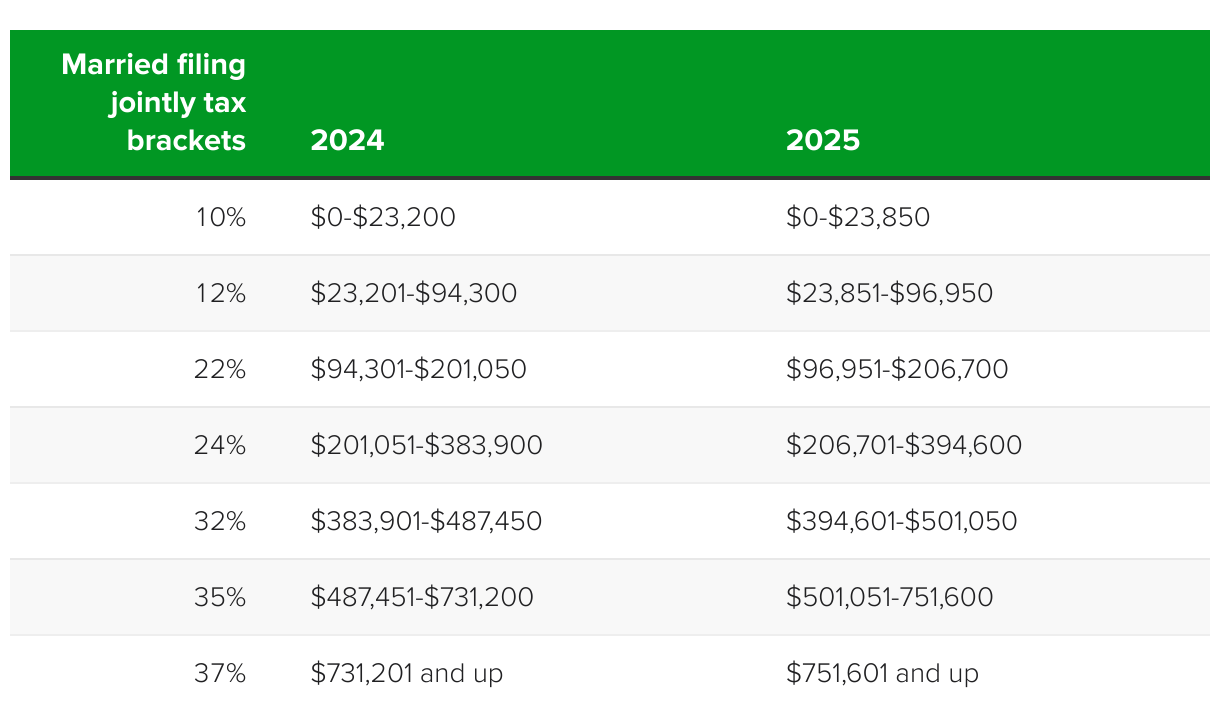

The 2025 married joint federal tax withholding table is your roadmap to ensuring that the right amount of taxes are withheld from your paycheck throughout the year. By using this table, you can prevent under- or over-withholding, allowing you to maximize your refund when tax season rolls around. Joint filing offers a range of tax benefits, including lower tax rates and higher income thresholds for certain deductions and credits, making it a smart financial move for many couples.

When you harness the power of the married joint federal tax withholding table, you can take control of your tax situation and potentially increase your refund. By ensuring that your withholding aligns with your tax liability, you can avoid any surprises come tax time and put yourself in the best position to maximize your refund. With the right strategy and a solid understanding of the 2025 tax withholding table, you can make the most of joint filing and enjoy a larger refund this year.

## Turbocharge Your Refund with the Latest Federal Tax Tips

To turbocharge your refund even further, it’s essential to stay up to date on the latest federal tax tips and strategies. From maximizing deductions and credits to taking advantage of tax-saving opportunities, there are countless ways to optimize your tax situation and boost your refund. By staying informed and proactive when it comes to your taxes, you can make the most of the married joint federal tax withholding table and maximize your refund in 2025.

In conclusion, by leveraging the power of joint filing and the 2025 married joint federal tax withholding table, you can supercharge your tax refund and put yourself in a strong financial position. With the right knowledge and strategies, you can take control of your tax situation and optimize your refund potential. So, don’t wait any longer – start maximizing your refund today with the latest federal tax tips and the married joint federal tax withholding table. Happy filing!

Federal Withholding Tax Table 2025 Married Jointly

new federal income tax brackets for 2025

image.cnbcfm.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

what are federal income tax rates for 2024 and 2025? – foundation

www.ntu.org

2025 tax code changes: everything you need to know | rgwm insights

rgwealth.com

2025 tax brackets: irs releases inflation adjustments, standard

images.axios.com

single filer 2025 tax brackets just dropped and tik tok is

i.redd.it

2025 tax changes – are you prepared?

www.nelsonfinancialplanning.com

federal income tax brackets and irs tax tables for 2025

thecollegeinvestor.com

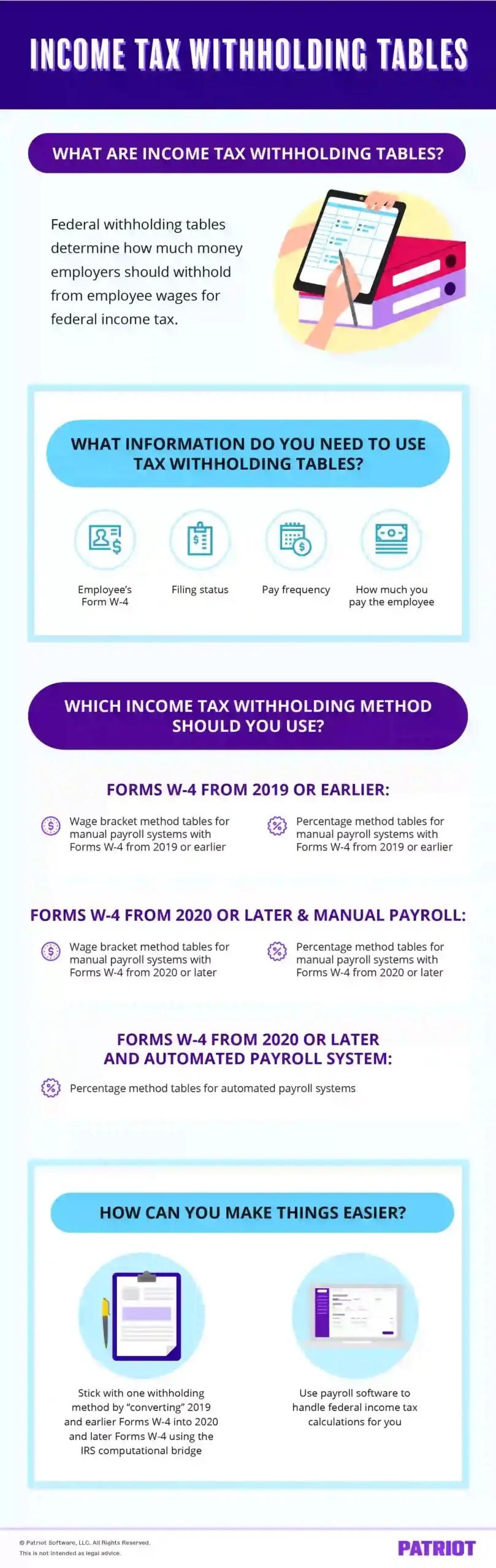

federal income tax withholding tables for 2025: a guide

www.patriotsoftware.com

the irs will soon set its new 2025 tax brackets. here's what to

img.datawrapper.de