Federal Withholding Tax Table 2025 Over 65 – # Feeling Taxed? Cheer up! 2025 Federal Tax Breaks for Seniors #

Are you a senior citizen feeling the pinch of taxes every year? Well, cheer up! The 2025 federal tax code has some silver linings for seniors that are sure to brighten your day. From increased deductions to special credits, there are several ways that seniors can save on their taxes this year. So sit back, relax, and let’s explore some of the tax breaks that are in store for you in 2025.

Brighten Your Day: Silver Linings in the 2025 Tax Code for Seniors

One of the most exciting tax breaks for seniors in 2025 is the increase in the standard deduction for those over the age of 65. This means that you can deduct a larger amount of your income before calculating your taxes, resulting in potentially lower tax liability. In addition to the standard deduction, seniors may also be eligible for a special tax credit for elderly and disabled individuals, providing even more savings come tax time.

Another silver lining in the 2025 tax code for seniors is the expansion of the medical expense deduction. Seniors often have higher medical expenses than younger individuals, so being able to deduct a larger portion of these expenses can lead to significant tax savings. Whether it’s prescription medications, doctor visits, or long-term care costs, these expenses can add up quickly, so having the ability to deduct them can make a big difference in your tax bill.

In addition to these deductions and credits, seniors may also benefit from tax-free retirement account contributions and distributions, as well as special exemptions for social security income. These provisions in the tax code are designed to help seniors retain more of their hard-earned money and enjoy their retirement years to the fullest. So don’t let taxes bog you down – take advantage of these silver linings in the 2025 tax code and brighten your day with some extra savings.

In conclusion, the 2025 federal tax code has some great news for seniors in the form of increased deductions, special credits, and other tax breaks. So if you’re feeling taxed, remember that there are silver linings waiting for you in the tax code. Take advantage of these opportunities to save money and make the most of your retirement years. Cheers to a brighter tax season ahead!

Federal Withholding Tax Table 2025 Over 65

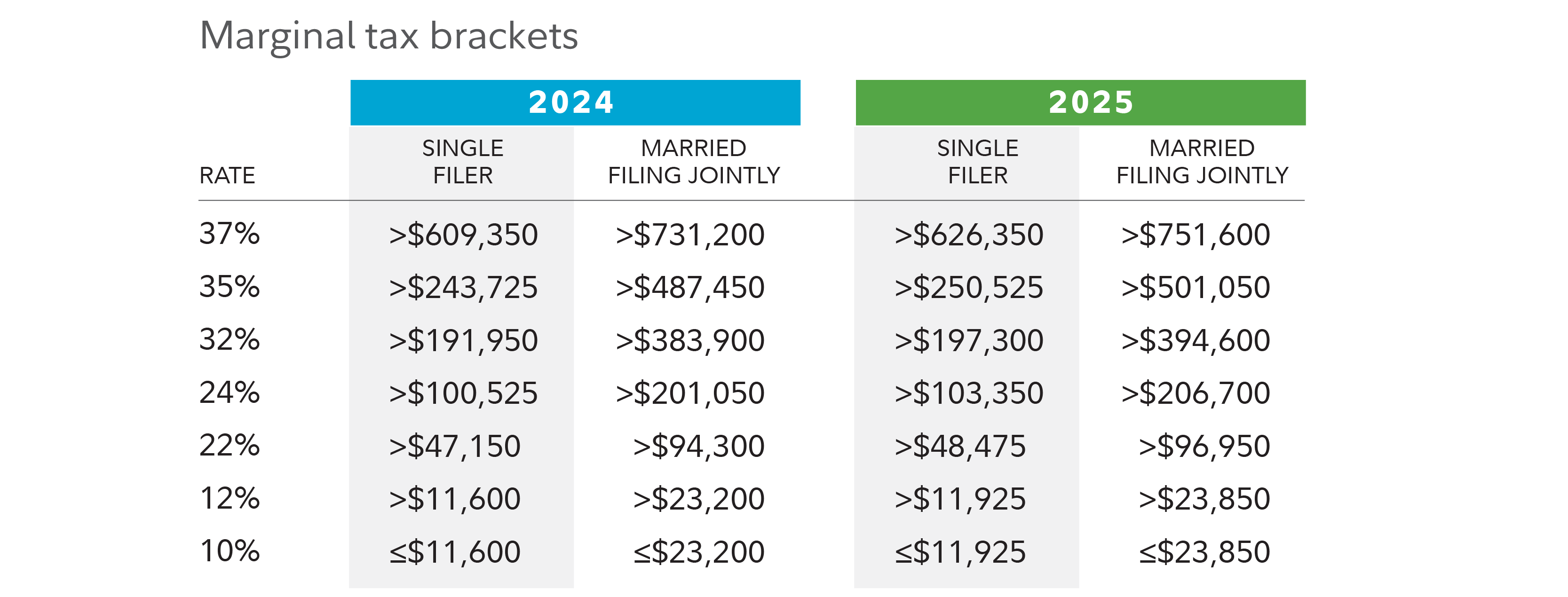

new federal income tax brackets for 2025

image.cnbcfm.com

single filer 2025 tax brackets just dropped and tik tok is

i.redd.it

2025 social security, pbgc projected covered compensation figures

www.mercer.com

<”img” class="”size-full”" src="”https://www.whitecoatinvestor.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-29-at-9.46.08-AM.png”" alt="”how" 1="brackets" 2="work" 3="[2025" 4="tax" 5="brackets"/> | white coat investor” width=”960″ height=”1316″]

how tax brackets work [2025 tax brackets] | white coat investor

www.whitecoatinvestor.com

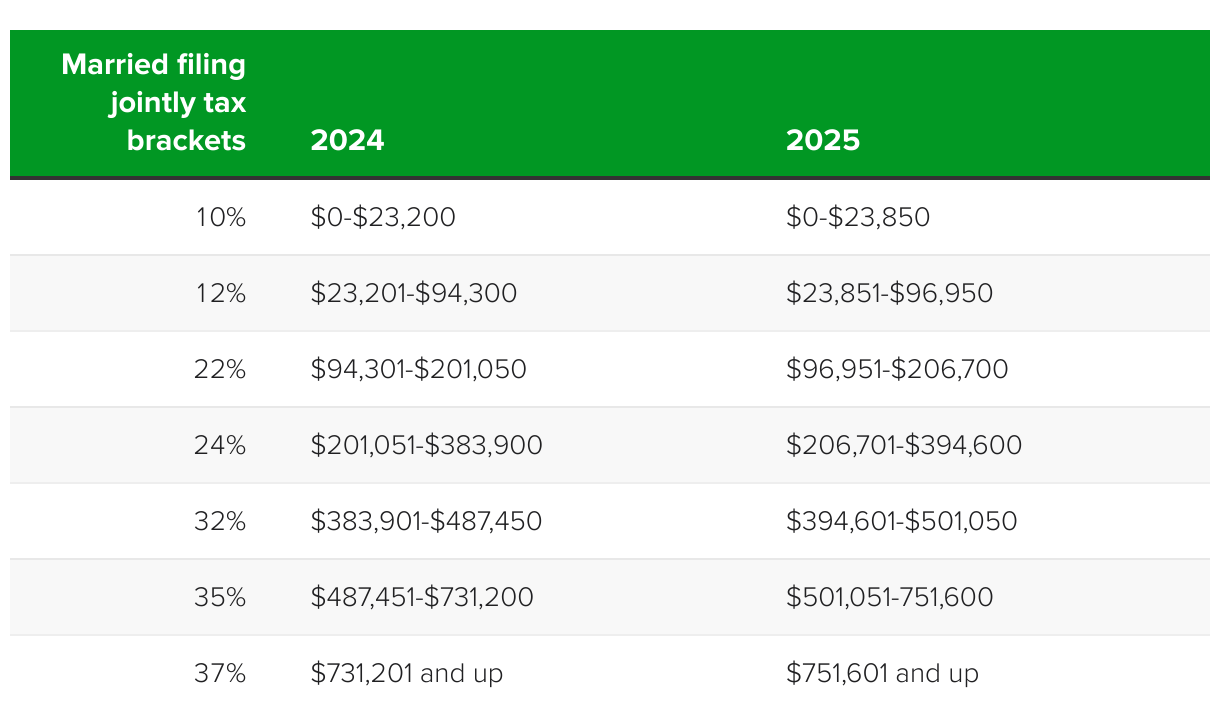

tax brackets 2025 | planning for tax cuts | fidelity

www.fidelity.com

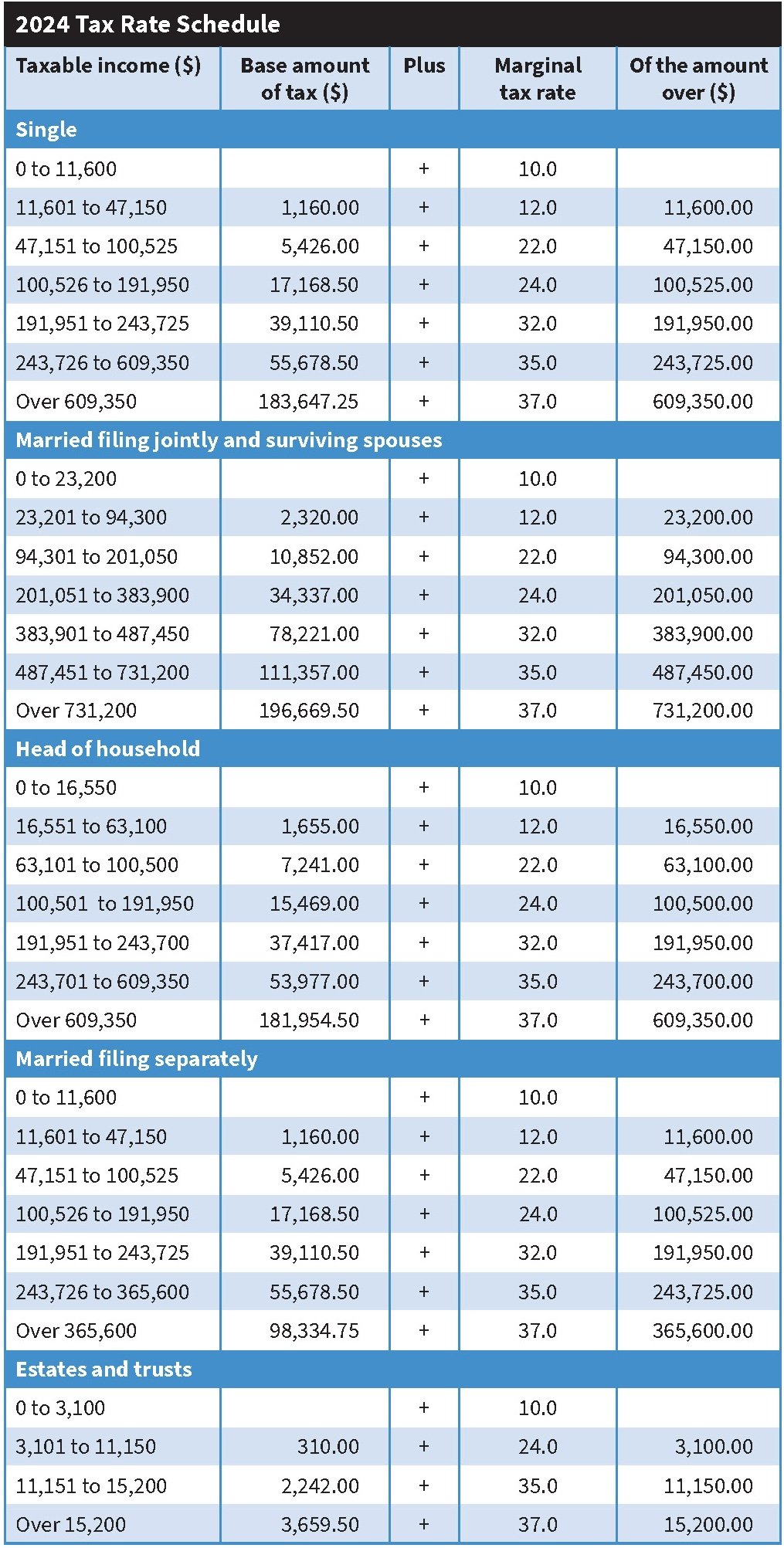

tax guide and resources for 2024 | tan wealth management

images.squarespace-cdn.com

2025 publication 15-t

![]()

tcja: why your taxes are likely to increase in 2026 and what to do

cdn.shortpixel.ai

the irs will soon set its new 2025 tax brackets. here's what to

img.datawrapper.de

2025 tax brackets: new ideal incomes for workers and retirees

i2.wp.com