Illinois W4 Form 2025 – # Mastering Your Taxes: Illinois W4 Form 2025 Explained!

Are you ready to take control of your taxes like never before? Look no further than the Illinois W4 Form 2025! This seemingly daunting document is actually your key to unlocking a world of tax savings and financial empowerment. Let’s dive in and discover how you can become a tax wizard with just a few easy tips and tricks!

## Unlock the Secrets of the Illinois W4 Form 2025!

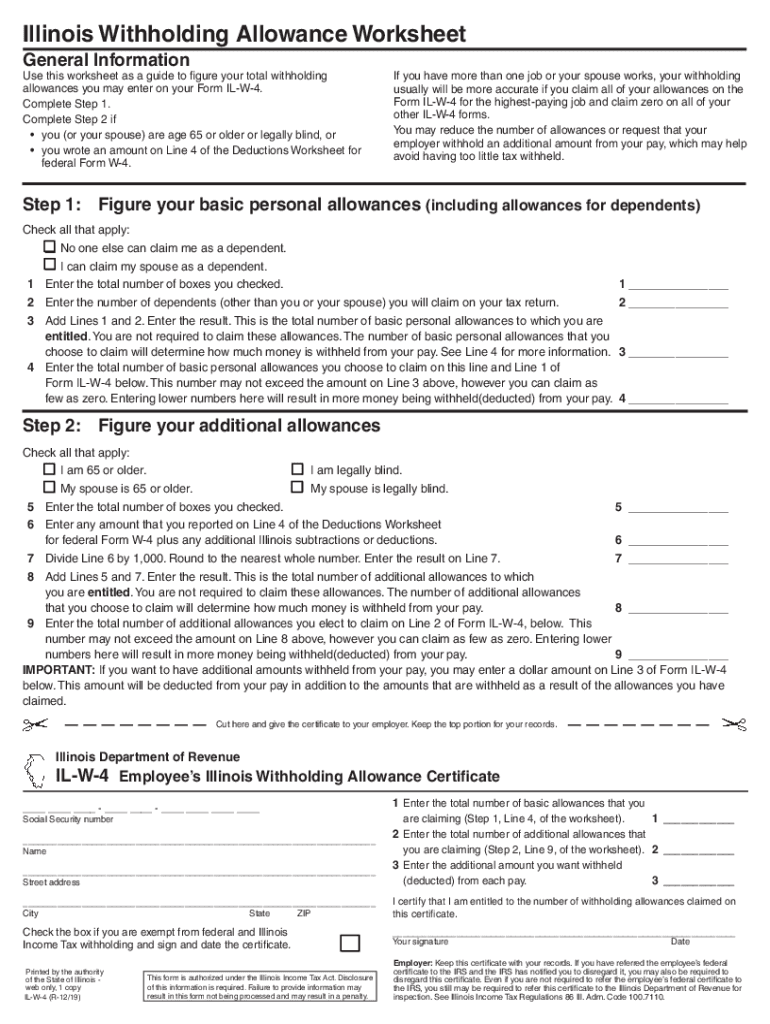

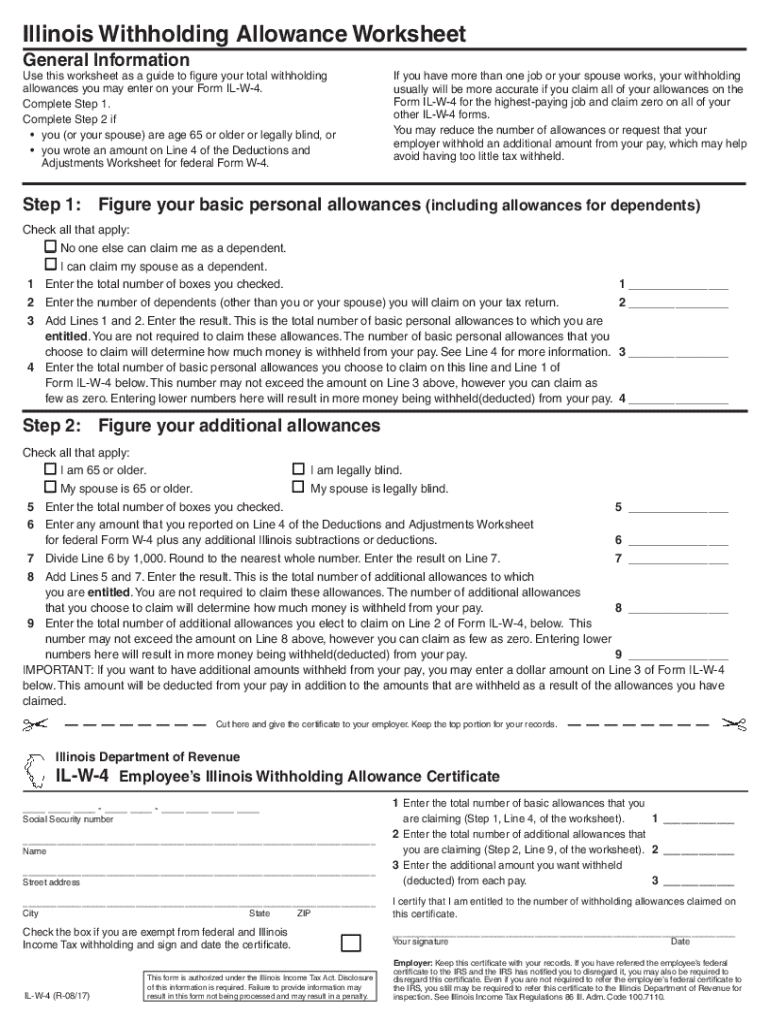

The Illinois W4 Form 2025 may look intimidating at first glance, but fear not! By breaking down each section and understanding the purpose behind the questions, you can confidently navigate through this form like a pro. Remember, the information you provide on this form will determine how much money is withheld from your paycheck for taxes. By filling it out accurately, you can ensure that you’re not overpaying or underpaying your taxes throughout the year.

One key section to pay attention to is the number of allowances you claim. The more allowances you claim, the less money will be withheld from your paycheck for taxes. However, claiming too many allowances could result in owing money come tax season. It’s important to strike a balance and adjust your allowances as needed based on any life changes such as getting married, having children, or taking on a second job. By mastering this section of the form, you can optimize your tax withholding and keep more money in your pocket throughout the year.

## Become a Tax Wizard with These Easy Tips and Tricks!

Another important aspect of the Illinois W4 Form 2025 is the section where you can elect to have additional money withheld from your paycheck. This can be a strategic move if you anticipate owing taxes at the end of the year or if you want to maximize your tax refund. By utilizing this feature, you can take control of your tax situation and avoid any surprises when tax season rolls around.

Don’t forget to review your Illinois W4 Form 2025 regularly, especially after major life events. Whether you get a raise, change jobs, or have a child, these events can impact your tax situation. By staying on top of your W4 form and making adjustments as needed, you can ensure that you’re not overpaying or underpaying your taxes. With a little diligence and attention to detail, you can become a tax wizard and master your taxes like never before!

In conclusion, the Illinois W4 Form 2025 doesn’t have to be a source of stress or confusion. By taking the time to understand each section and make informed decisions about your tax withholding, you can take control of your financial future and unlock a world of tax savings. With these easy tips and tricks, you’ll be well on your way to becoming a tax wizard and maximizing your tax refund. So don’t delay, get started on mastering your taxes today!

Illinois W4 Form 2025

2023-2025 form il il-w-4 fill online, printable, fillable, blank

www.pdffiller.com

w4 form: fill out & sign online | dochub

www.pdffiller.com

how to fill out a w4 for dummies: fill out & sign online | dochub

www.pdffiller.com

w4 form (2025) | fill and sign online with lumin

imagedelivery.net

illinois withholding allowance worksheet: fill out & sign online

www.pdffiller.com

w4: fill out & sign online | dochub

www.pdffiller.com

form il-w-4 employee's and other payee's illinois withholding

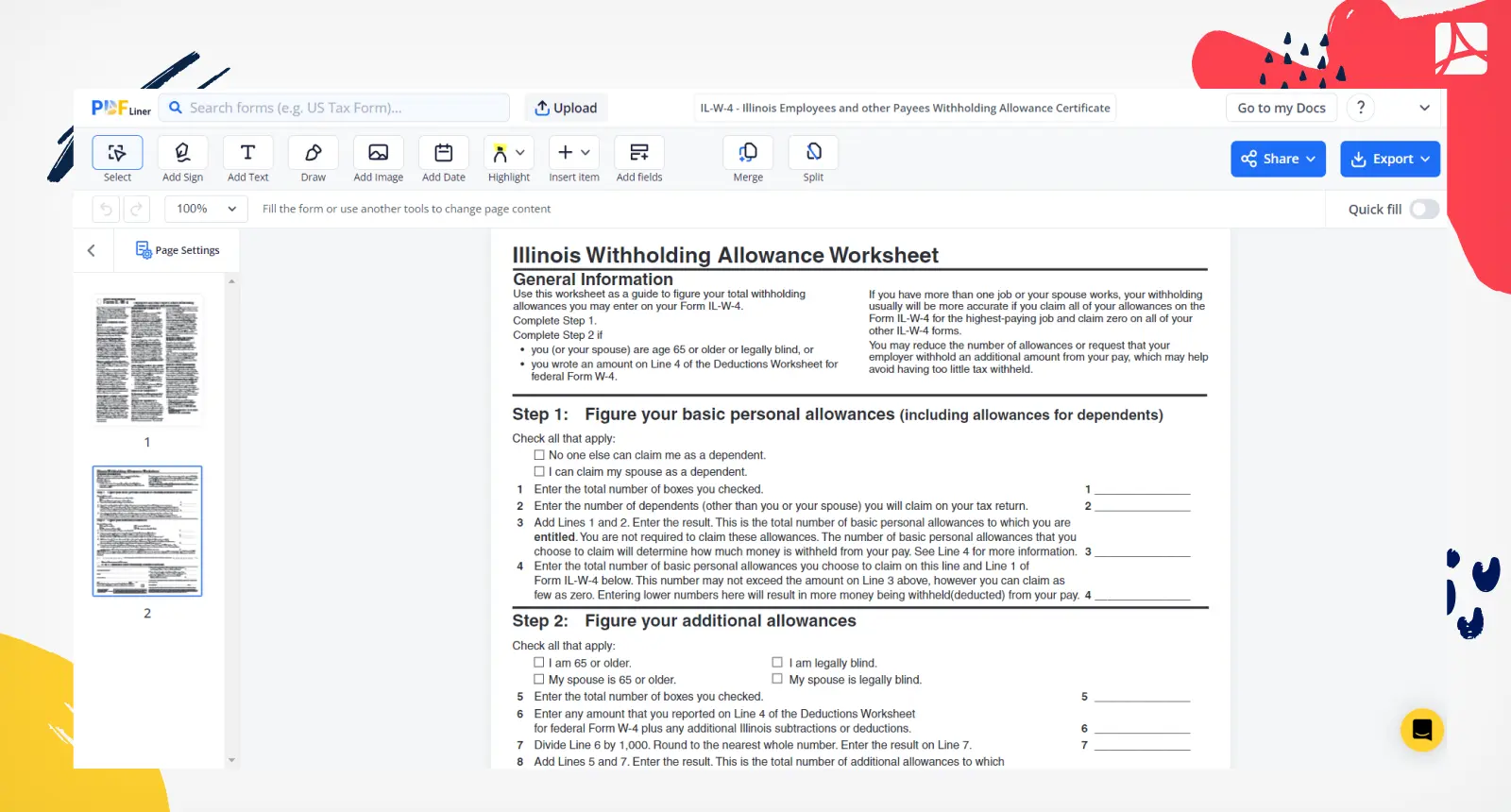

il-w-4, illinois employees withholding allowance certificate— pdfliner

pdfliner.com

state w-4 form | detailed withholding formsstate chart (2025)

www.patriotsoftware.com

w-2 vs. w-4 — what's the difference and how to file – hourly, inc.

cdn.prod.website-files.com