Kentucky W4 Form 2025 – # Unlock Your Tax Savings: Kentucky W4 Form 2025 Explained!

Are you ready to take control of your tax savings and maximize your benefits? Look no further than the Kentucky W4 Form 2025! This simple form holds the key to unlocking potential tax savings that you may not even know you’re eligible for. By understanding how to properly fill out and utilize this form, you can ensure that you’re getting the most out of your hard-earned money.

## Discover How to Maximize Your Tax Savings with Kentucky W4 Form 2025!

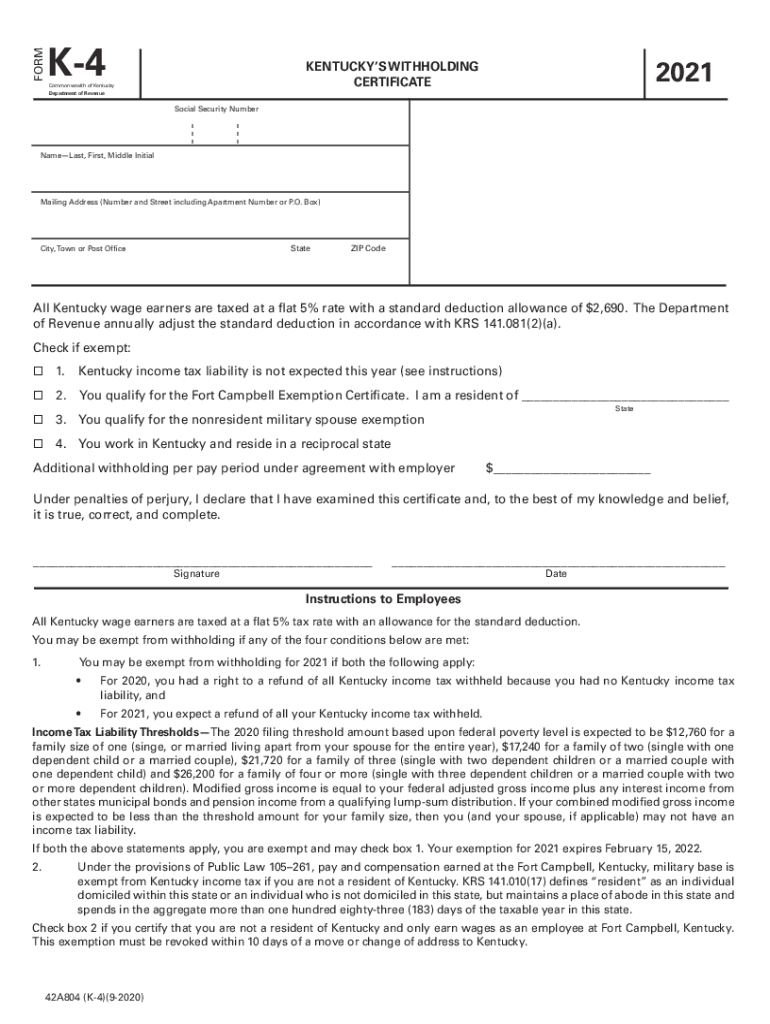

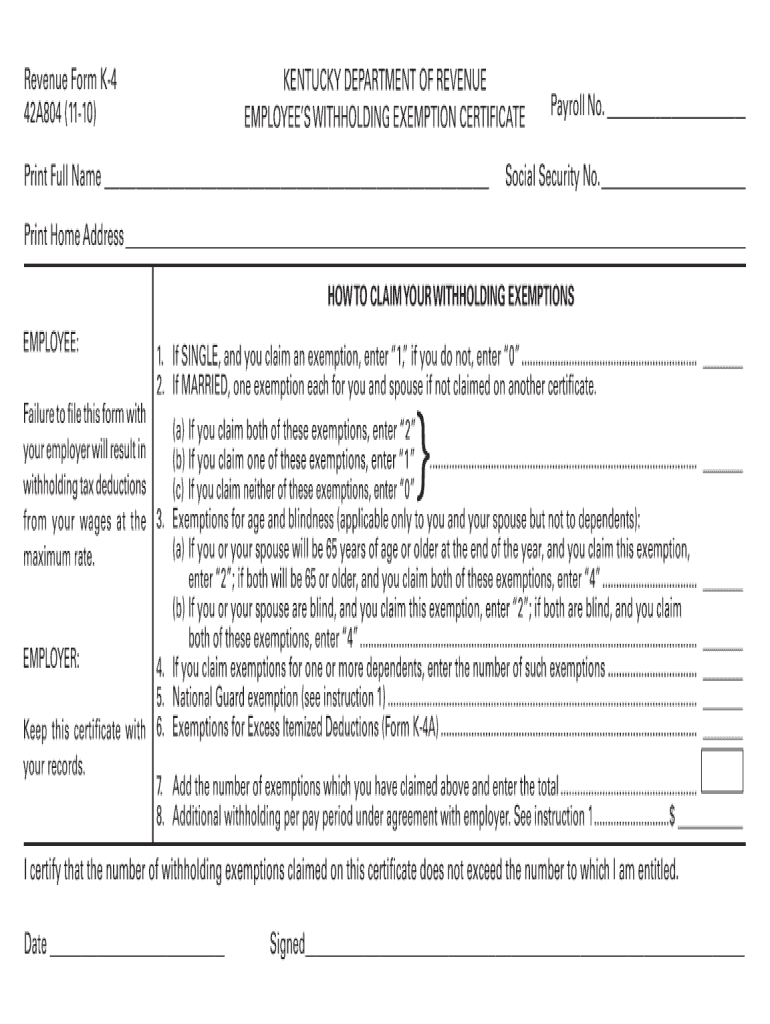

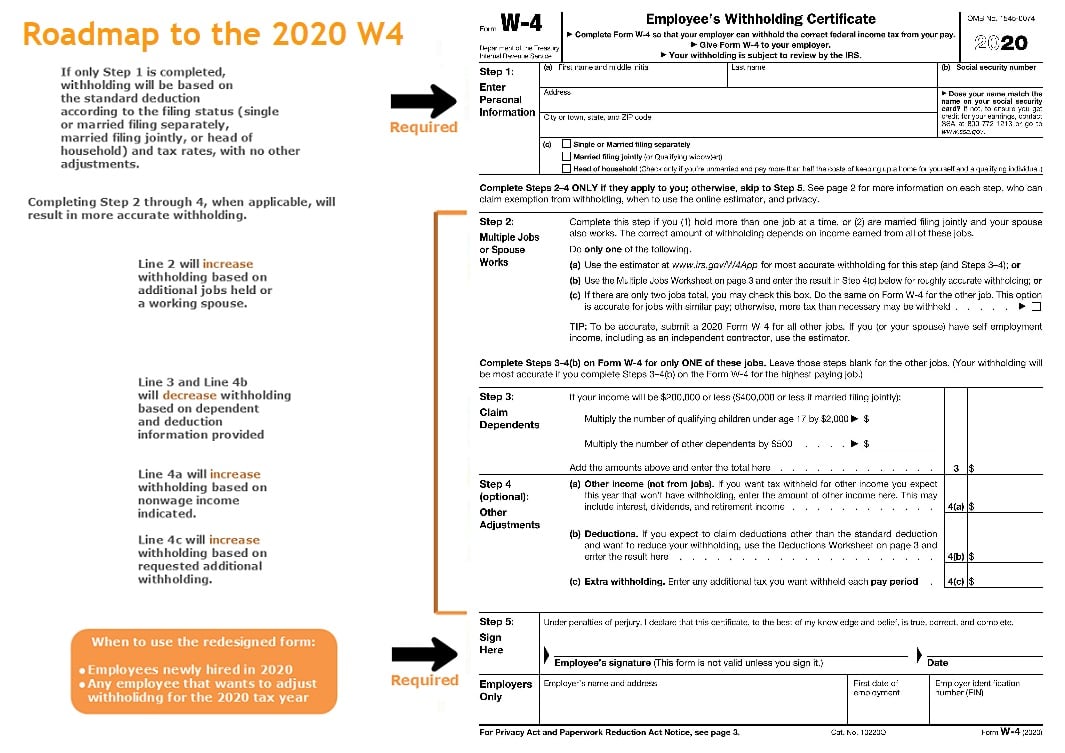

The Kentucky W4 Form 2025 is designed to help you accurately report your withholding allowances to your employer, ensuring that the right amount of taxes are withheld from your paychecks. By carefully filling out this form, you can potentially lower your tax liability and increase your take-home pay. Whether you’re a single filer, married with children, or have multiple sources of income, the Kentucky W4 Form 2025 provides options for you to customize your withholding to fit your individual tax situation.

In addition to adjusting your withholding allowances, the Kentucky W4 Form 2025 also allows you to claim additional tax credits and deductions that you may qualify for. By taking advantage of these opportunities, you can reduce your taxable income and potentially receive a larger tax refund. From education expenses to retirement contributions, the Kentucky W4 Form 2025 offers a variety of ways for you to save money on your taxes and keep more of your earnings in your pocket.

## Simplifying Kentucky W4 Form 2025: Your Key to Unlocking Tax Benefits!

Navigating the world of taxes can be overwhelming, but the Kentucky W4 Form 2025 is here to help simplify the process and make it easier for you to understand and take advantage of tax benefits. By taking the time to review and complete this form accurately, you can ensure that you’re not overpaying on your taxes and missing out on potential savings. Don’t let tax season stress you out – use the Kentucky W4 Form 2025 to unlock the tax benefits that you deserve!

In conclusion, the Kentucky W4 Form 2025 is a valuable tool that can help you maximize your tax savings and keep more money in your pocket. By understanding how to properly fill out this form and take advantage of the available tax credits and deductions, you can ensure that you’re making the most of your tax situation. So don’t delay – unlock your tax savings today with the Kentucky W4 Form 2025!

Kentucky W4 Form 2025

ky w4: fill out & sign online | dochub

www.pdffiller.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

kentucky paycheck calculator: formula to calculate net income

factorialhr.com

state w-4 form | detailed withholding formsstate chart (2025)

www.patriotsoftware.com

how to complete the 2025 w-4 form: a simple guide for household

54123.fs1.hubspotusercontent-na1.net

how to fill out a w4 for dummies: fill out & sign online | dochub

www.pdffiller.com

w4 form (2025) | fill and sign online with lumin

imagedelivery.net

w-2 vs. w-4 — what's the difference and how to file – hourly, inc.

cdn.prod.website-files.com

new w4 for 2021: what you need to know to get it done right

cdn2.hubspot.net

kentucky paycheck calculator: formula to calculate net income

factorialhr.com