Oregon W4 2025 Form – # Mastering Your Taxes: The Oregon W4 2025 Form Explained!

Tax season can be a daunting time for many individuals, but fear not! By understanding and mastering the Oregon W4 2025 form, you can take control of your taxes with confidence. This essential document is crucial for ensuring that the correct amount of taxes are withheld from your paycheck, ultimately helping you avoid any surprises come tax time. So, let’s demystify the Oregon W4 2025 form and unlock the secrets to mastering your taxes!

## Demystifying the Oregon W4 2025 Form!

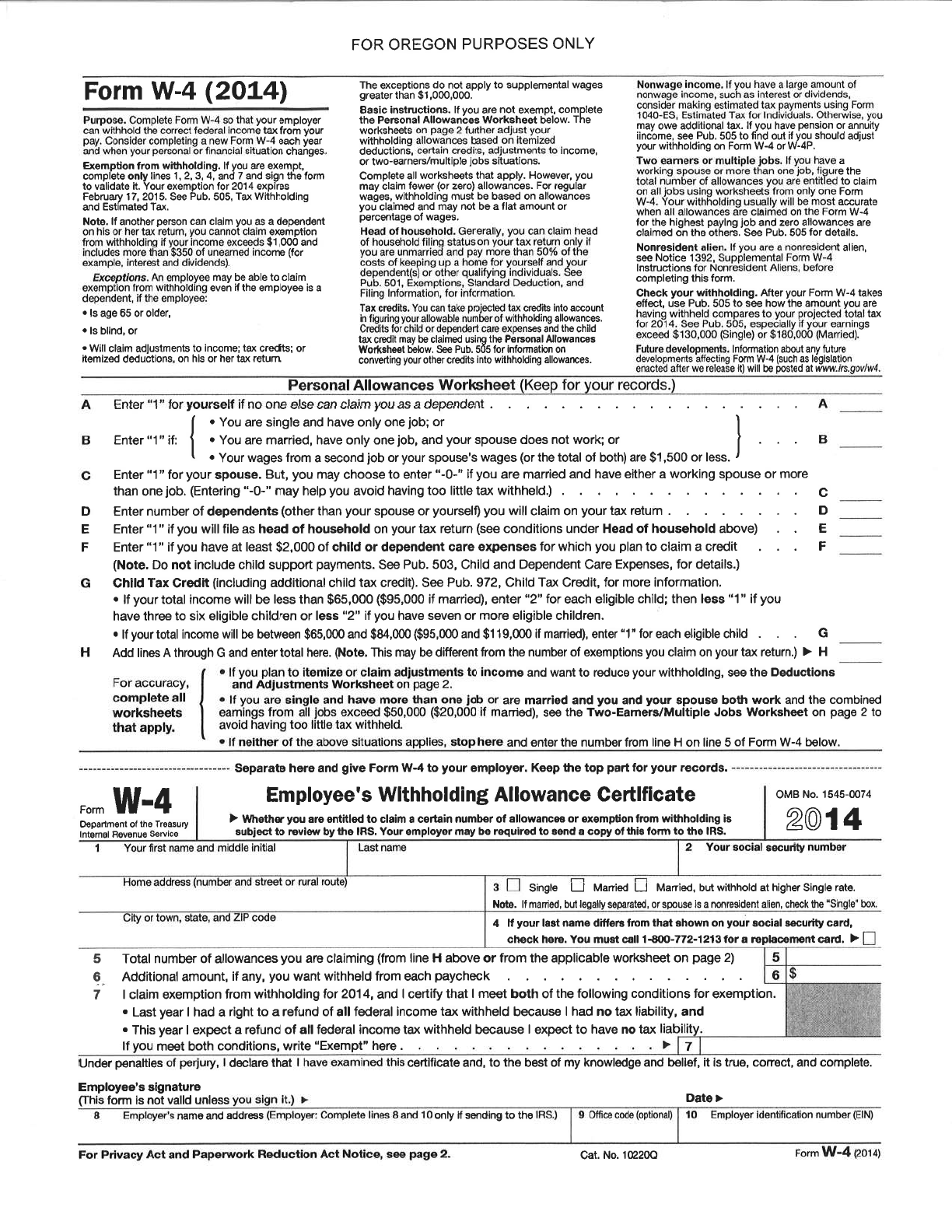

The Oregon W4 2025 form may seem complex at first glance, but breaking it down into manageable sections can make the process much simpler. One key aspect to pay attention to is the personal allowances section, where you can indicate how many allowances you are claiming. These allowances directly impact the amount of taxes withheld from your paycheck, so it’s important to accurately calculate them based on your individual circumstances. By understanding this section and making the proper adjustments, you can ensure that you are not overpaying or underpaying your taxes throughout the year.

Another important section of the Oregon W4 2025 form is the additional withholding section, where you can specify any extra amount you would like to have withheld from each paycheck. This can be particularly useful if you have additional income or if you want to ensure that enough taxes are withheld to cover any potential tax liabilities. By taking advantage of this section and strategically adjusting your withholding, you can better plan for tax season and avoid any unexpected financial burdens. Remember, mastering your taxes is all about taking control and making informed decisions to optimize your financial situation.

## Unlock the Secrets to Mastering Your Taxes!

As you navigate through the Oregon W4 2025 form, don’t hesitate to seek out resources or assistance if you encounter any confusion. The Oregon Department of Revenue website offers valuable information and guidance on filling out the W4 form, helping you navigate any tricky sections or calculations. Additionally, consulting with a tax professional can provide personalized advice and support tailored to your specific tax situation. By utilizing these resources and taking the time to understand the intricacies of the Oregon W4 2025 form, you can empower yourself to take control of your taxes and make informed decisions that benefit your financial well-being. Remember, mastering your taxes is a journey, but with dedication and knowledge, you can conquer any tax challenge that comes your way.

In conclusion, mastering the Oregon W4 2025 form is a key step in taking control of your taxes and ensuring financial stability throughout the year. By demystifying the form and understanding its various sections, you can make informed decisions that optimize your tax withholding and prevent any surprises come tax season. So, embrace the challenge, unlock the secrets to mastering your taxes, and take charge of your financial future with confidence!

Oregon W4 2025 Form

2025 form or-w-4, oregon withholding, 150-101-402

fillable online forms uoregon w-4-oregon-withholding-instructions

www.pdffiller.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

2018-2025 form or or-wr fill online, printable, fillable, blank

www.pdffiller.com

oregon form w4p: fill out & sign online | dochub

www.pdffiller.com

w4 form (2025) | fill and sign online with lumin

imagedelivery.net

state w-4 form | detailed withholding formsstate chart (2025)

www.patriotsoftware.com

free oregon form w-4 (2014) – pdf | 341kb | 1 page(s)

www.speedytemplate.com

how to complete the 2025 w-4 form: a simple guide for household

info.homeworksolutions.com

irs form w-4 walkthrough, employee's withholding certificate (2025)

i.ytimg.com