TIN Number – The IRS need to procedure an enormous sum of information involving a huge selection of millions of US citizens. It’s not just the quantity of information that makes arranging it difficult, but in addition the difficulty of identifying folks. Because they often overlap with one yet another, there needs to become a regular tax system that can keep an eye on individuals apart from their names. This is the purpose of the Tax Number Online.

What’s the TIN number?

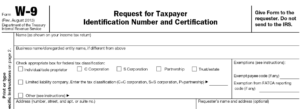

The Taxpayer Identification Number is actually a sequence of numbers that the Internal Revenue Service makes use of to determine taxpayers. The TIN number is in fact a wide expression that includes numerous varieties of identification numbers for filing tax for entities and people .

TIN could be issued either through the IRS (or even the Social Security Administration, (SSA). SSA issued only Social Security number (SSN) TINs, whilst IRS issued all other kinds.

What are the Different types of TINs

TIN, as pointed out over, is a phrase that handles several types identification numbers. Every sort is produced up of 9 digits.

Right here are five kinds of Taxpayer Identification Numbers:

1. Social Security Number (SSN)

This number is issued to people (citizens or long term residents) who are short term citizens within the U.S. SSN could be formatted as xxxxx-xxxxxx. This number is necessary to be eligible for lawful employment inside the United States, along with to receive government services like social security rewards.

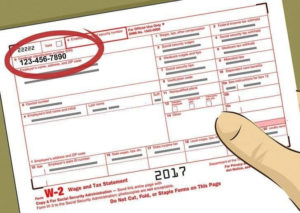

2. Employer Identification Number (EIN)

The IRS uses EIN to determine tax-eligible individuals, estates, trusts, or businesses . The employer’s tax ID number also has nine digits. It really is formatted in xxxxxxxxxxx, much like the SSN.

3. Individual Taxpayer Identification Numbers (ITIN)

The IRS problems ITINs to particular non-resident aliens in addition to their spouses and dependents . It’s organized in the exact same manner as SSN as xxxx-xxxxxx. However, ITIN usually commences using the number 9.

4. Taxpayer Identification Number for Pending U.S. Adoptions (ATIN)

If the adoptive parents are unable to obtain the SSN in their child, ATIN can only be employed for domestic adoption.

5. Preparer Taxpayer Identification Numbers (PTIN)

The IRS concerns a series of digits referred to as PTIN that’s used to recognize tax return preparers. This number serves since the tax return preparer’s identification number. It should be attached towards the area entitled “Paid Preparer” within the tax return that’s been organized for payment.

When needed to offer a TIN number, nearly all individuals use their Social Security numbers. When they don’t employ other individuals, one proprietors can choose to use EIN or SSN. Businesses, partnerships, estates and trusts should offer the IRS using an EIN.

Why do I want TIN?

The Taxpayer Identification number is actually a mandatory product that taxpayers must offer after they file their tax returns each and every year to the IRS. It will likely be employed by the IRS to determine them just like their name. When they are heading to say benefits or services from your government, taxpayers should consist of the number in almost any files related to tax filings or.

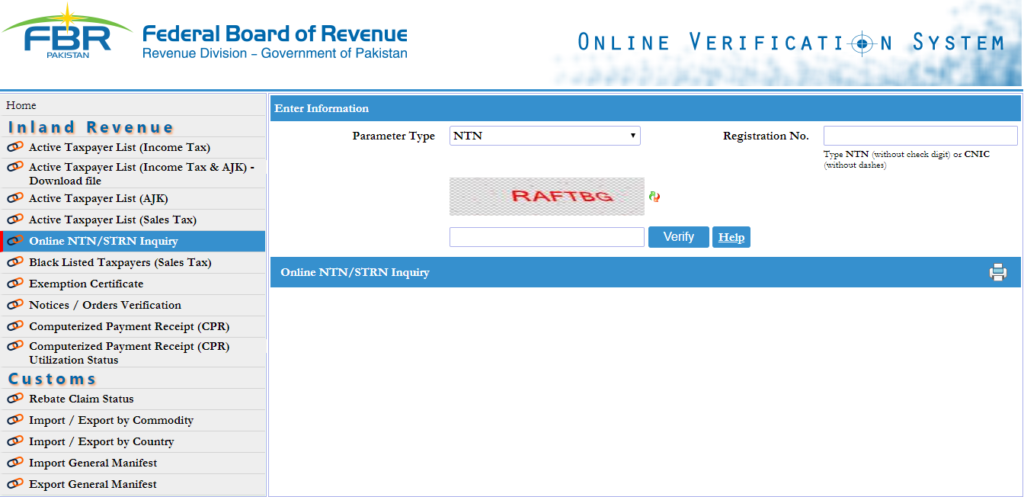

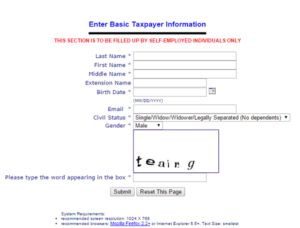

How can I use for a TIN?

You are able to use towards the IRS or SSA to get your tax identification number. Click this link: https://tinidentificationnumber.com/#How_Do_I_Apply_For_TIN to learn more How to Apply For a TIN Number.