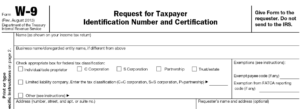

TIN Number – The IRS should procedure an enormous sum of information involving a huge selection of millions of US citizens. It is not just the volume of data which makes organizing it difficult, but also the difficulty of determining people. Because they often overlap with one an additional, there has to be a regular tax system that will monitor individuals apart from their names. This can be the purpose in the TIN Number Lookup.

What’s the TIN number?

The Taxpayer Identification Number is really a sequence of numbers that the Internal Revenue Service makes use of to identify taxpayers. The TIN number is actually a wide expression that features numerous types of identification numbers for submitting tax for individuals and entities .

TIN could be issued possibly by the IRS (or the Social Security Administration, (SSA). SSA issued only Social Security number (SSN) TINs, although IRS issued all other kinds.

What are the Different types of TINs

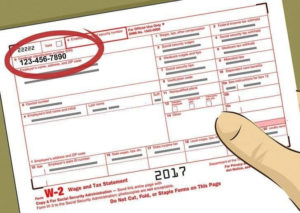

TIN, as mentioned above, is really a phrase that addresses a few kinds identification numbers. Each and every type is created up of 9 digits.

Here are 5 kinds of Taxpayer Identification Numbers:

1. Social Security Number (SSN)

This number is issued to folks (citizens or long term inhabitants) that are short-term residents in the U.S. SSN can be formatted as xxxxx-xxxxxx. This number is important to be eligible for authorized employment in the United States, in addition to to receive government services like social security benefits.

2. Employer Identification Number (EIN)

The IRS utilizes EIN to identify tax-eligible individuals, trusts, estates, or businesses . The employer’s tax ID number also has 9 digits. However, it is formatted in xxxxxxxxxxx, similar to the SSN.

3. Individual Taxpayer Identification Numbers (ITIN)

The IRS issues ITINs to certain non-resident aliens as well as their spouses and dependents . It’s organized in the exact same way as SSN as xxxx-xxxxxx. ITIN usually commences using the number 9.

4. Taxpayer Identification Number for Pending U.S. Adoptions (ATIN)

ATIN can only be used for domestic adoption when the adoptive mothers and fathers are not able to obtain the SSN of their child.

5. Preparer Taxpayer Identification Numbers (PTIN)

The IRS issues a series of digits called PTIN that’s accustomed to recognize tax return preparers. This number serves because the tax return preparer’s identification number. It should be attached to the section entitled “Paid Preparer” in the tax return that has been organized for compensation.

When necessary to provide a TIN number, the vast majority of individuals use their Social Security numbers. If they do not use others, one proprietors can select to use EIN or SSN. Companies, estates, partnerships and trusts should supply the IRS with an EIN.

How come I need TIN?

The Taxpayer Identification number is a mandatory merchandise that taxpayers should offer after they file their tax returns each and every year towards the IRS. It will be utilized by the IRS to recognize them just like their name. When they are going to say advantages or services from your government, taxpayers should consist of the number in any documents associated to tax filings or.

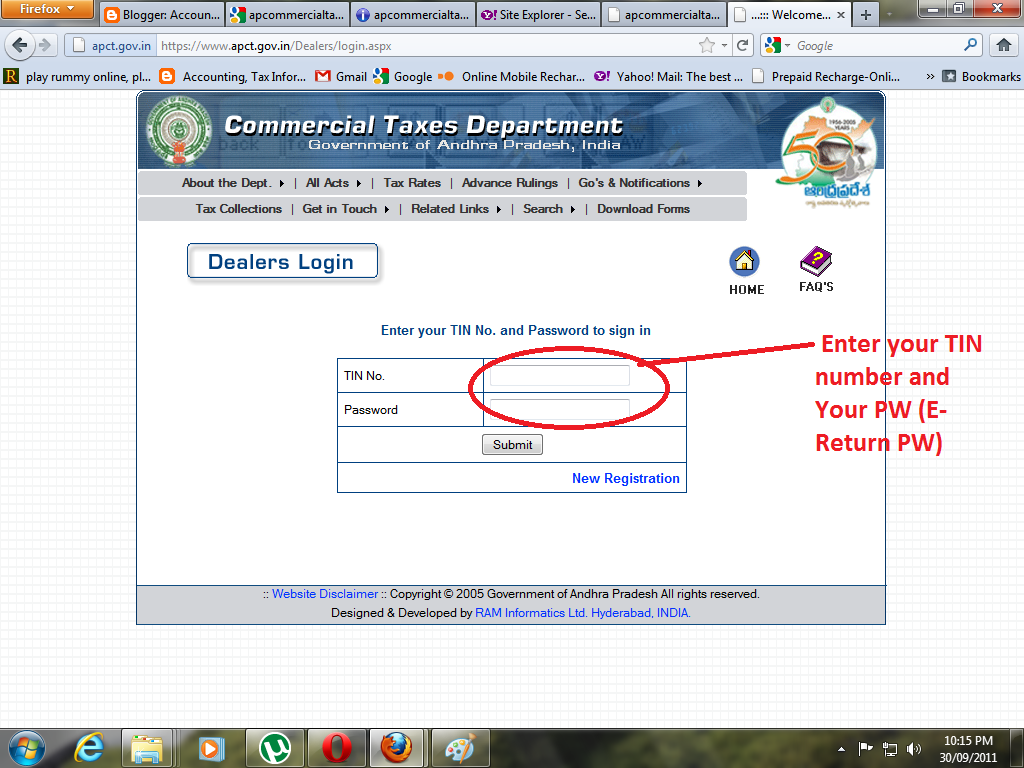

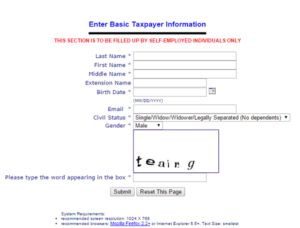

How do I use for any TIN?

You can apply to the IRS or SSA to get your tax identification number. Click this link: https://tinidentificationnumber.com/#How_Do_I_Apply_For_TIN to learn more How to Apply For a TIN Number.