W2 And W3 Forms 2025 – # Get Ready for Tax Season 2025 with W2 and W3 Forms!

Start Preparing Early for Tax Season 2025!

Tax season can often be a stressful time for many individuals, but it doesn’t have to be! By starting to prepare early for Tax Season 2025, you can save yourself a lot of time and hassle when it comes time to file your taxes. One of the best ways to get ahead of the game is by gathering all necessary documents, such as your W2 and W3 forms, well in advance. This way, you can ensure that you have everything you need to accurately report your income and deductions.

Additionally, starting early allows you to identify any potential errors or missing information on your W2 and W3 forms. By reviewing these documents ahead of time, you can avoid any delays or issues with your tax return later on. You can also start to organize any additional paperwork, such as receipts or bank statements, that may be needed to support your tax filing. Taking these proactive steps will not only make the tax filing process smoother but can also help you maximize your deductions and credits.

With the right preparation and organization, Tax Season 2025 can be a breeze. So, grab a cup of coffee, put on your favorite music, and start getting your W2 and W3 forms in order. By starting early and staying organized, you can set yourself up for a stress-free tax season and potentially even receive a nice tax refund. Don’t wait until the last minute – get ahead of the game and make Tax Season 2025 your easiest tax season yet!

Simplify Your Tax Filing with W2 and W3 Forms!

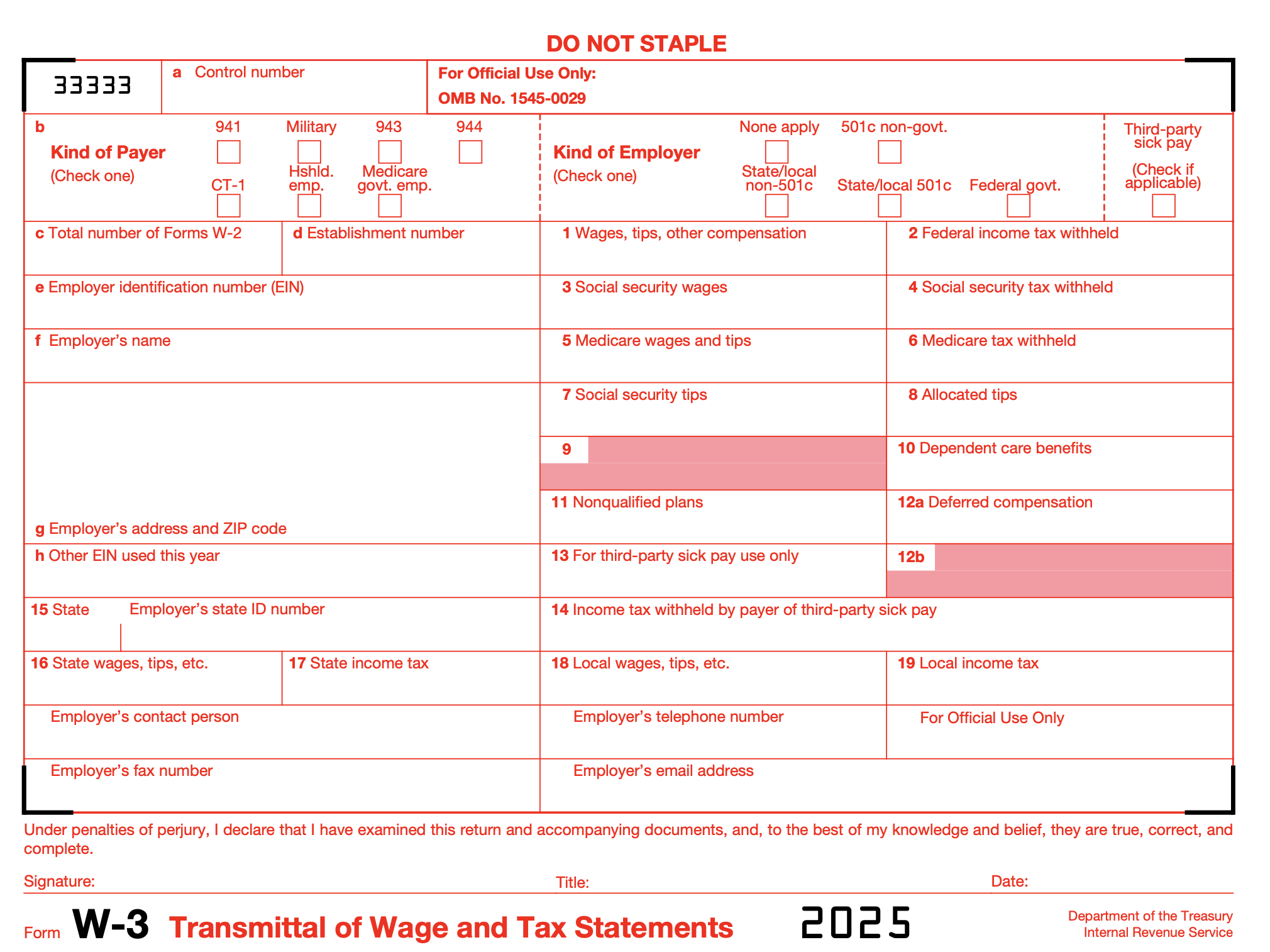

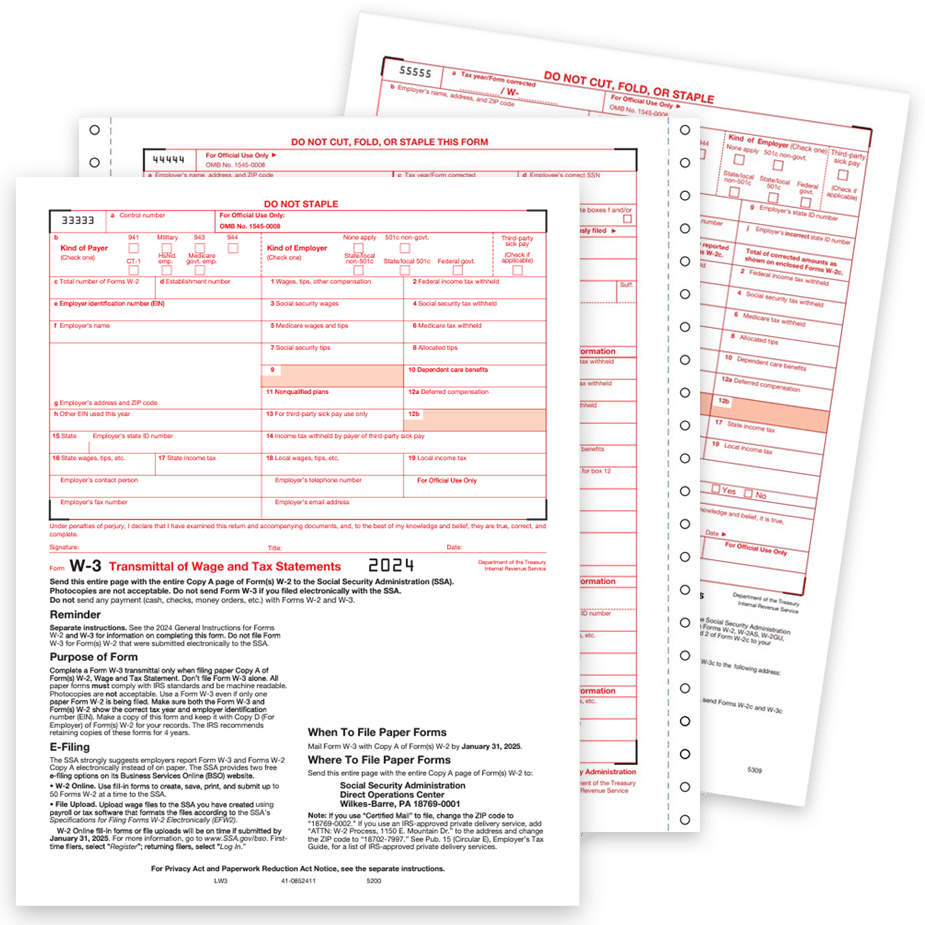

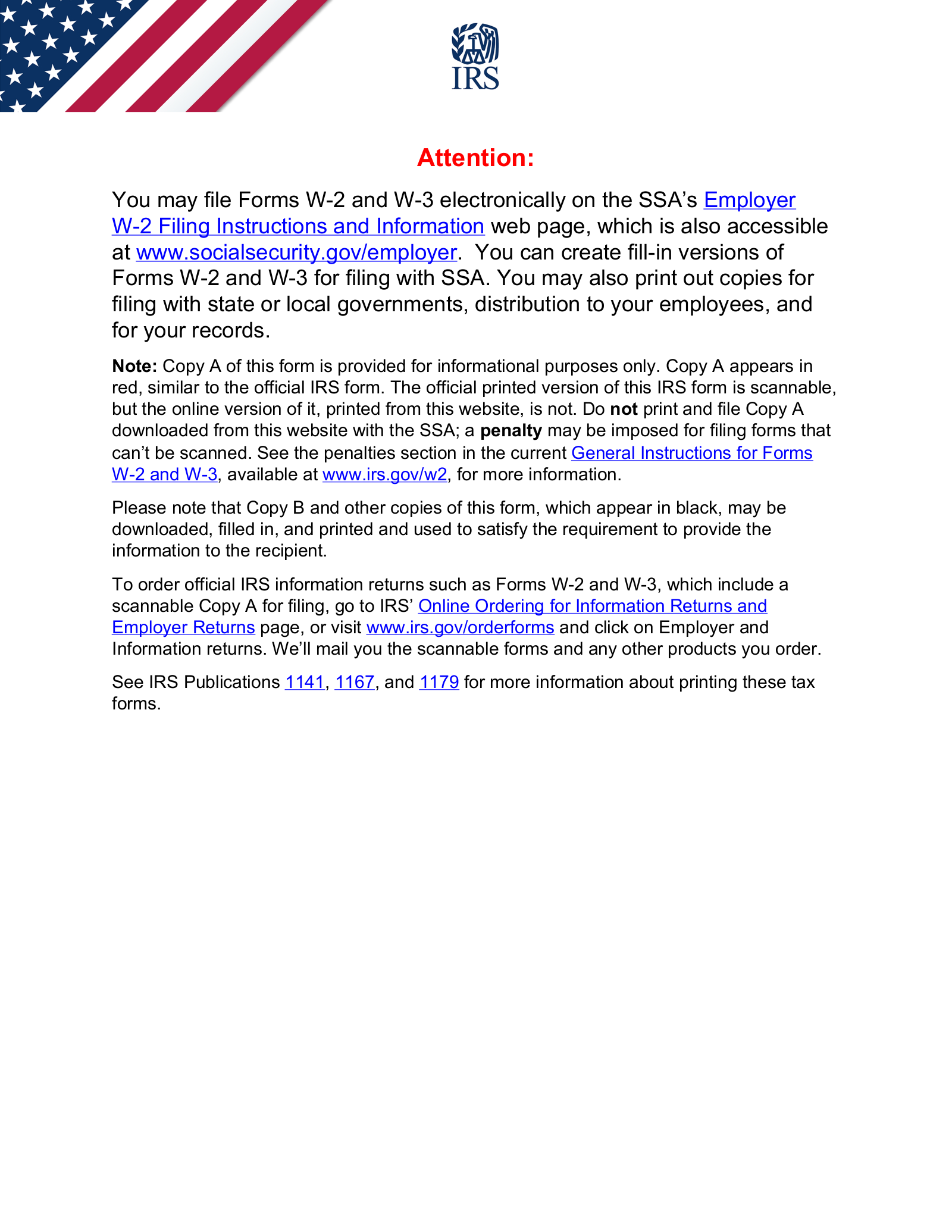

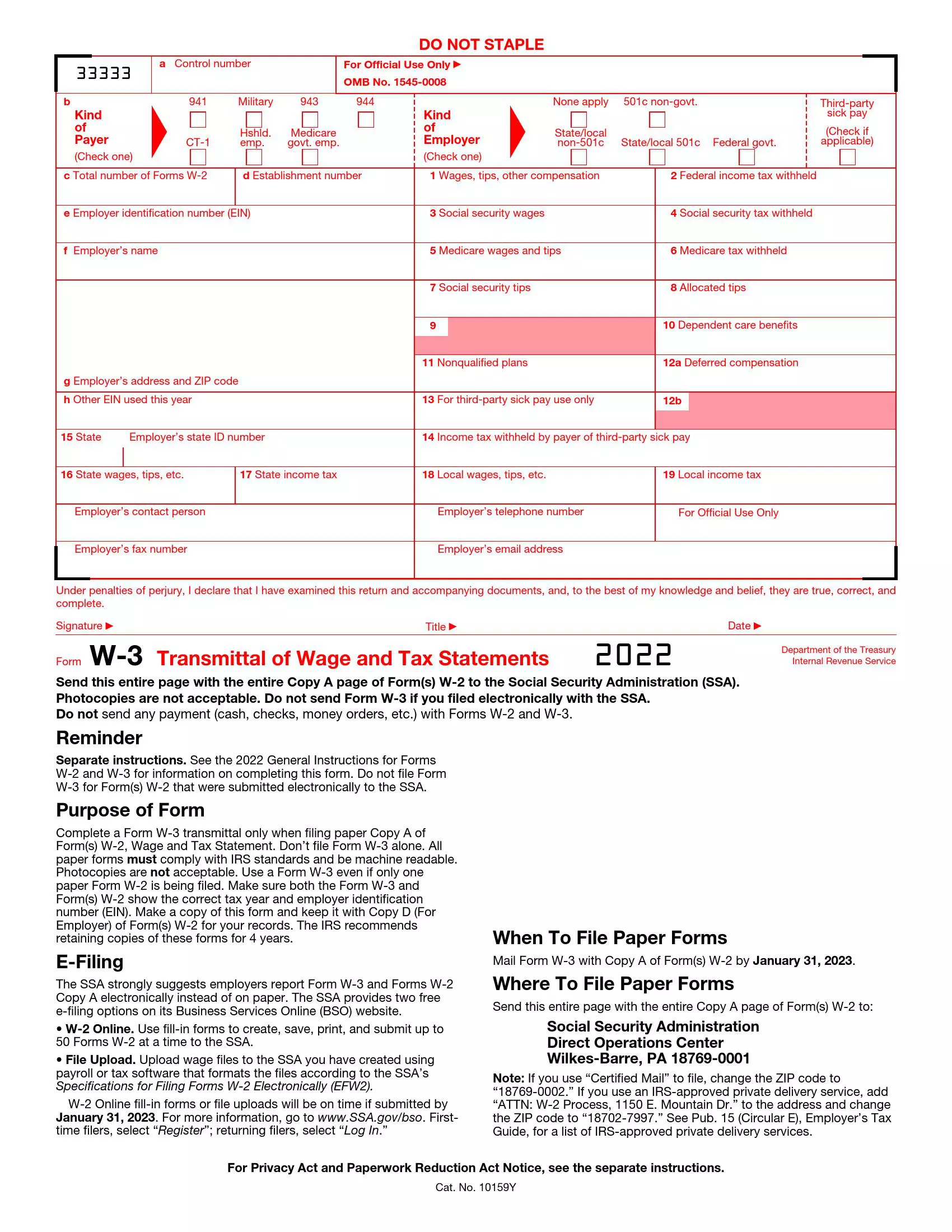

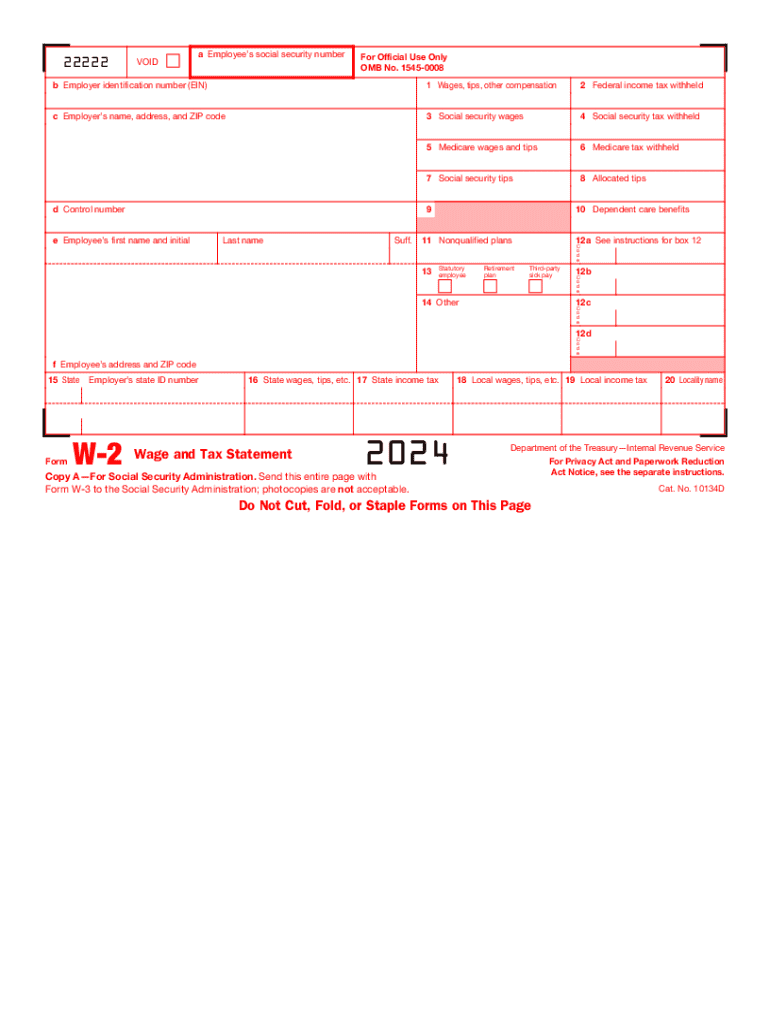

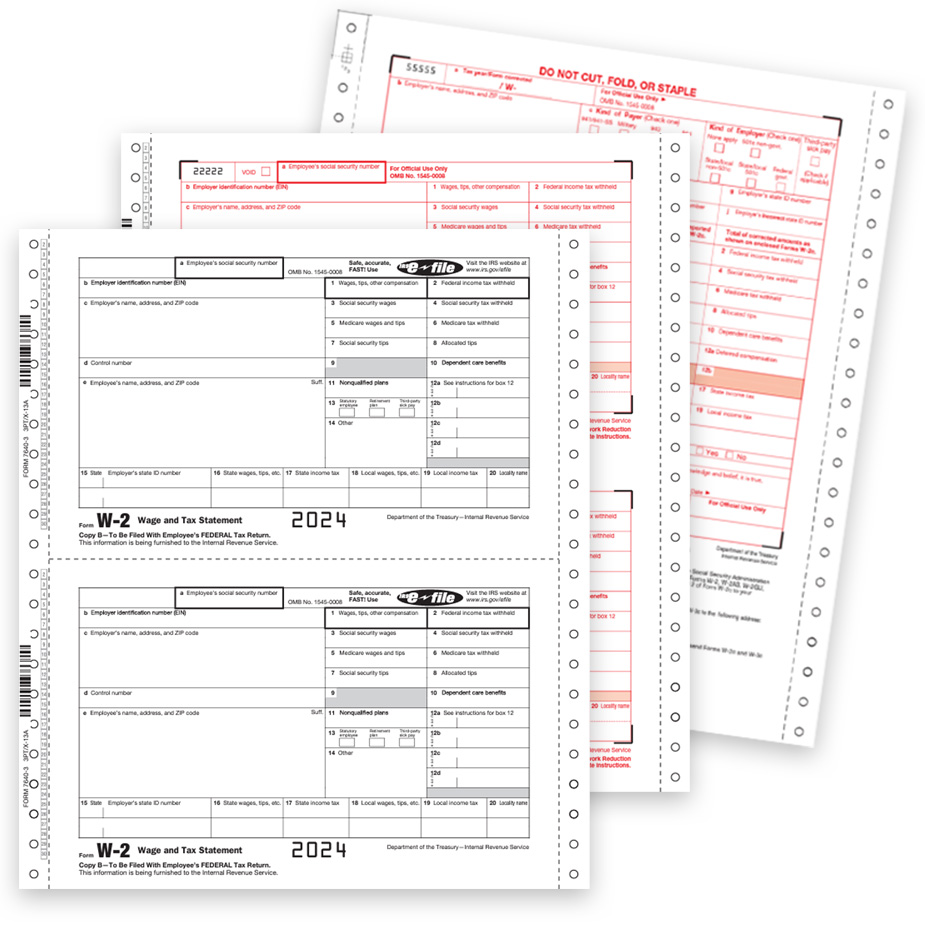

When it comes to filing your taxes, having the correct forms is essential. Your W2 form, provided by your employer, details your wages, tips, and other compensation for the year. This form is crucial for accurately reporting your income to the IRS. The W3 form, on the other hand, is the transmittal form that summarizes all of the W2 forms submitted by an employer. Ensuring that both forms are accurate and complete is key to a smooth tax filing process.

By utilizing your W2 and W3 forms, you can simplify your tax filing and reduce the likelihood of errors. These forms provide the IRS with essential information about your income, taxes withheld, and other relevant details. By having all of this information in one place, you can streamline the tax filing process and potentially avoid any audits or penalties. So, make sure to review your W2 and W3 forms carefully and reach out to your employer if you notice any discrepancies.

In conclusion, getting ready for Tax Season 2025 with your W2 and W3 forms doesn’t have to be a daunting task. By starting early, staying organized, and utilizing these essential documents, you can make the tax filing process a breeze. So, grab those forms, gather your documents, and get ready to tackle Tax Season 2025 with confidence!

W2 And W3 Forms 2025

u.s. employment tax forms | yearend guide for small business owners

www.bookkeeping-essentials.com

w2 and w3 filing deadlinesfor the 2025 tax season!

i.ytimg.com

w3 transmittal summary forms for w2 filing – discount tax forms

cdn.discounttaxforms.com

free irs form w-2 | wage and tax statement – pdf – eforms

eforms.com

irs form w-3 ≡ fill out printable pdf forms online

formspal.com

2024 form irs w-2 fill online, printable, fillable, blank – pdffiller

www.pdffiller.com

how to file 2024 w-2 and w-3 forms for the 2025 tax season

i.ytimg.com

w2 carbonless continuous multi-part tax forms – discount tax forms

cdn.discounttaxforms.com

w3052 – form w-3 transmittal employers federal 2-part (carbonless)

cdn11.bigcommerce.com

w-2 instructions for 2025: getting started with tax filing

cdn.prod.website-files.com