W4 Form 2025 Exemption From Withholding – # Tax Breaks Ahead: How to Score W4 Form 2025 Exemption!

Are you ready to take control of your finances and maximize your tax breaks? Look no further than the W4 Form 2025 Exemption! This powerful tool allows you to reduce the amount of taxes withheld from your paycheck, putting more money back in your pocket. With a little knowledge and some strategic planning, you can unleash the full potential of tax breaks and put yourself on the path to financial success.

## Unleash the Power of Tax Breaks!

One of the key benefits of the W4 Form 2025 Exemption is the ability to adjust your tax withholding to better reflect your actual tax liability. By claiming exemptions on your W4 form, you can reduce the amount of taxes taken out of each paycheck, giving you more money to use as you see fit. Whether you want to save for a big purchase, pay off debt, or simply have more disposable income, taking advantage of tax breaks can help you reach your financial goals faster.

Another advantage of the W4 Form 2025 Exemption is the flexibility it offers. You can adjust your exemptions at any time throughout the year, allowing you to adapt to changes in your financial situation. Whether you get a raise, have a child, or experience any other life event that affects your taxes, you can update your exemptions to ensure you’re not overpaying. By staying proactive and staying on top of your exemptions, you can make the most of tax breaks and keep more money in your pocket.

## Your Guide to W4 Form 2025 Exemption

If you’re ready to take control of your taxes and maximize your tax breaks, follow these simple steps to score the W4 Form 2025 Exemption. First, review your current withholding status and determine if you’re overpaying. If you’re getting a large refund at tax time, chances are you could benefit from adjusting your exemptions. Next, use the IRS withholding calculator to estimate the number of exemptions you should claim based on your income, deductions, and credits. Finally, update your W4 form with the new exemptions and submit it to your employer. With a little effort and some strategic planning, you can unleash the full power of tax breaks and keep more of your hard-earned money.

In conclusion, the W4 Form 2025 Exemption is a valuable tool that can help you take control of your finances and maximize your tax breaks. By adjusting your exemptions and staying proactive throughout the year, you can reduce the amount of taxes withheld from your paycheck and keep more money in your pocket. So don’t wait any longer – unleash the power of tax breaks and put yourself on the path to financial success today!

W4 Form 2025 Exemption From Withholding

:max_bytes(150000):strip_icc()/IRSFormW4-e498685ca7d941dca203c1b3b05b9b9f.png)

w-4: how to fill out the 2025 tax withholding form

www.investopedia.com

irs form w-4 walkthrough, employee's withholding certificate (2025)

i.ytimg.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

how to fill out an exempt w4 form | 2024 | money instructor

i.ytimg.com

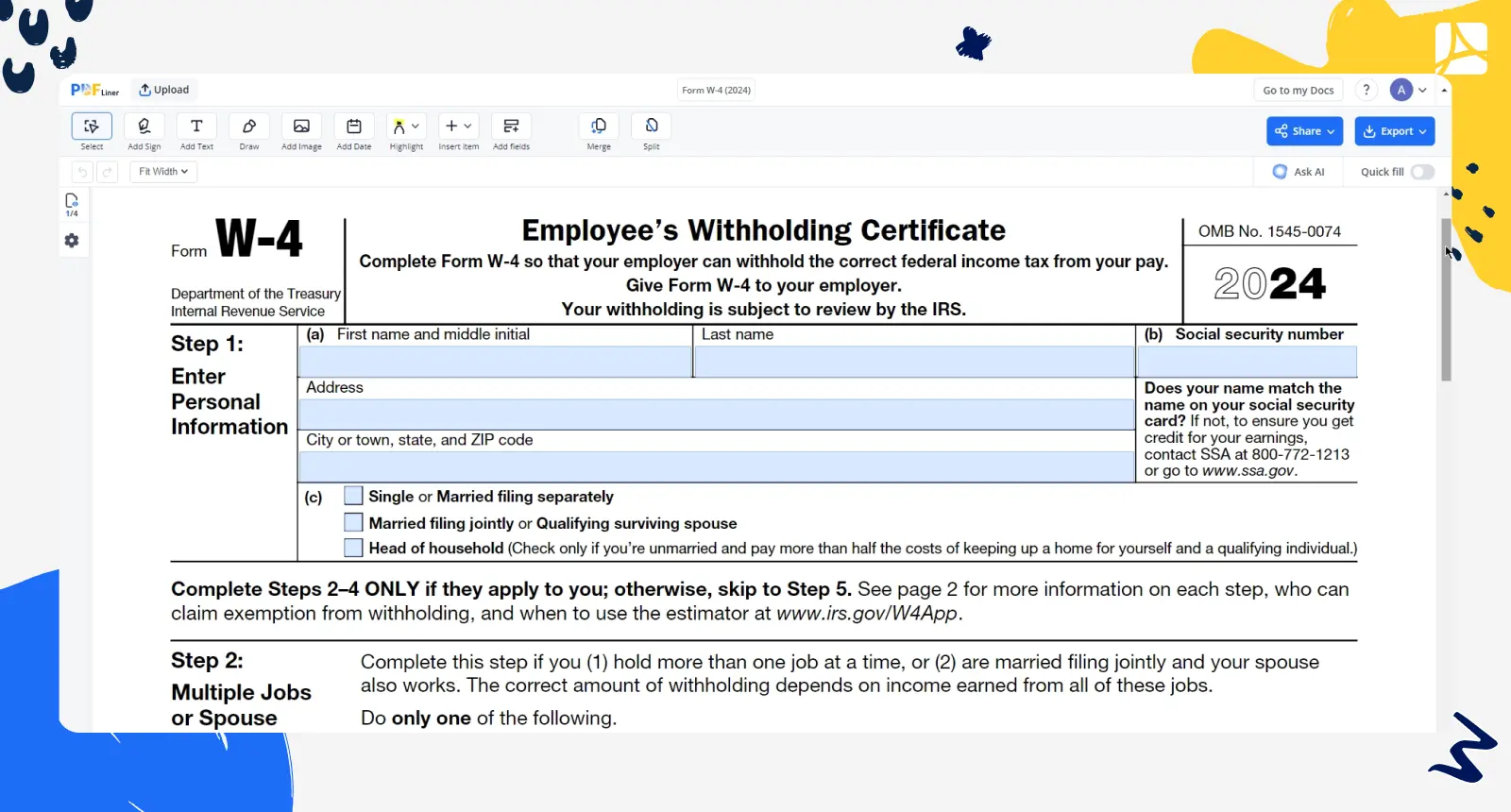

fill form w-4 2024 online : simplify tax withholding | pdfliner

pdfliner.com

how to fill out irs form w 4 exempt

i.ytimg.com

🚨please stop going exempt and expecting a miracle during tax

lookaside.instagram.com

w-4 form: employee's withholding certificate instructions

blog.pdffiller.com