W4 Form 2025 How To Fill Out – # Mastering the W4 Form in 2025: The Ultimate Guide!

Are you ready to conquer the infamous W4 form in 2025? Say goodbye to the confusion and frustration that often comes with filling out this essential document. With the right knowledge and guidance, you can breeze through the process with ease and confidence. Let’s dive into the secrets of the W4 form and unlock the key to mastering it like a pro!

## Unveiling the Secrets of the W4 Form in 2025

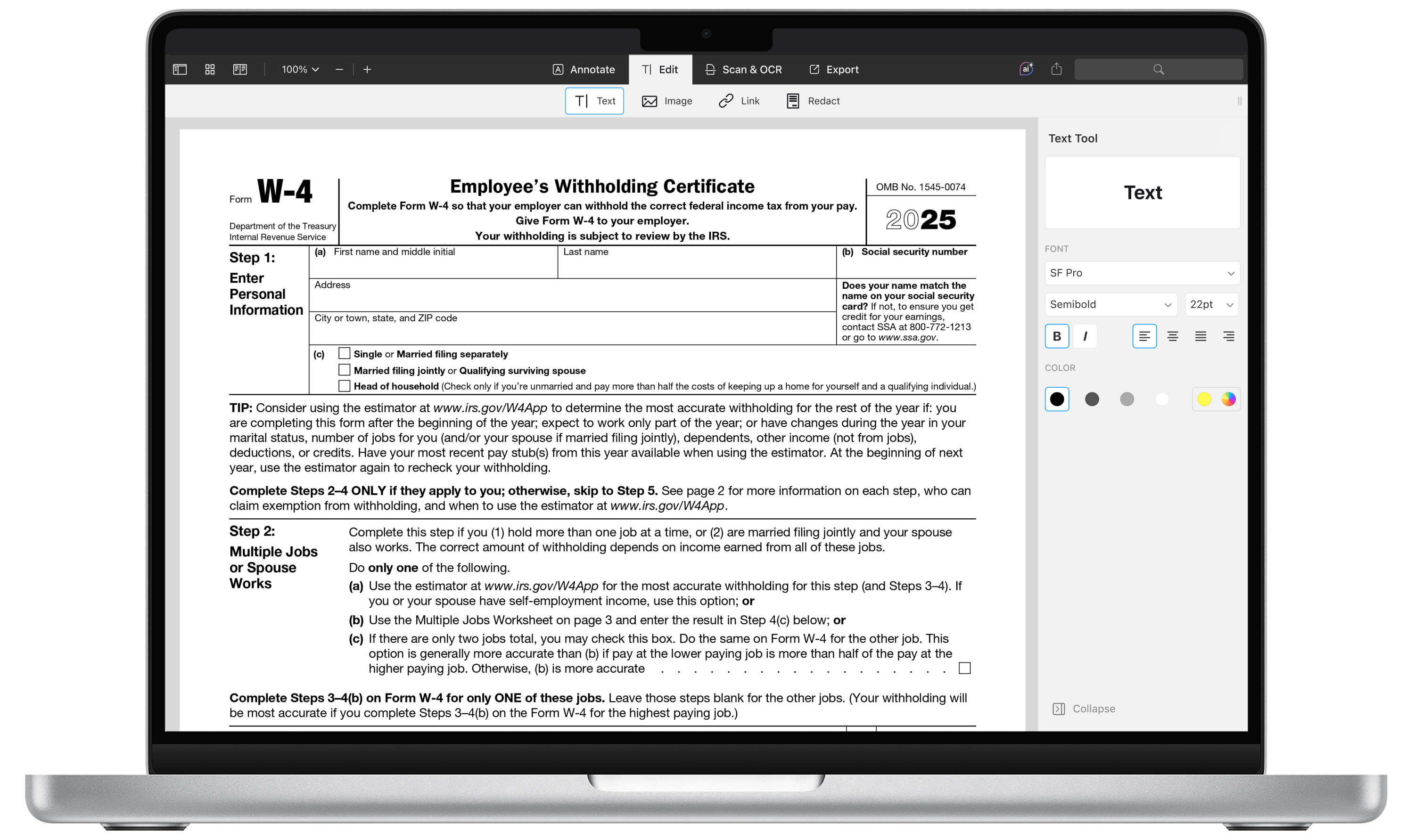

The W4 form may seem like a daunting task, but fear not! In 2025, we’re here to help you unravel its mysteries and make the process as smooth as possible. The key to understanding the W4 form lies in its purpose – to determine how much federal income tax should be withheld from your paycheck. By demystifying the various sections and calculations, you’ll be well on your way to mastering this essential document.

One of the most important aspects of the W4 form is accurately filling out your personal information. From your name and address to your filing status and number of allowances, each detail plays a crucial role in determining your tax withholding. In 2025, we’re here to guide you through each section step by step, ensuring that you provide the correct information and avoid any potential errors. With our expert tips and tricks, you’ll be able to navigate the W4 form with confidence and precision.

As 2025 brings new updates and changes to the tax landscape, it’s more important than ever to stay informed and up to date on the latest W4 form requirements. By staying ahead of the curve and mastering the intricacies of this document, you’ll be better prepared to handle any tax-related challenges that come your way. With our ultimate guide to the W4 form, you’ll be equipped with the knowledge and skills needed to conquer this important task and take control of your financial future.

## Step-by-Step Guide to Conquering the W4 Form

Ready to tackle the W4 form like a pro? In 2025, we’re here to walk you through the process step by step, ensuring that you have everything you need to fill out the form accurately and efficiently. From understanding your filing status to calculating the right number of allowances, our comprehensive guide will empower you to take charge of your tax withholding and make informed decisions that benefit your financial well-being.

The first step in mastering the W4 form is determining your filing status. Whether you’re single, married, or head of household, understanding your status will impact how much tax is withheld from your paycheck. By following our expert advice and tips, you’ll be able to navigate this section with ease and ensure that you provide the correct information for your individual situation. With our guidance, you’ll be able to make informed choices that align with your financial goals and priorities.

Once you’ve determined your filing status, the next step is calculating the number of allowances you should claim on the W4 form. This number will directly affect how much tax is withheld from your paycheck, so it’s crucial to get it right. In 2025, we’re here to help you navigate this calculation and make informed decisions that maximize your tax savings and minimize any potential tax liabilities. With our step-by-step instructions and expert insights, you’ll be able to confidently complete this section of the W4 form and set yourself up for financial success.

As you work your way through the W4 form, it’s important to review your information carefully and double-check for any errors or omissions. In 2025, we’re here to guide you through this process and ensure that you submit an accurate and complete form. By taking the time to review your details and make any necessary corrections, you’ll avoid potential issues down the line and ensure that your tax withholding is in line with your financial goals. With our comprehensive guide to the W4 form, you’ll have all the tools and resources you need to conquer this essential task and take control of your taxes in 2025 and beyond.

In conclusion, mastering the W4 form in 2025 is within your reach with the right knowledge and guidance. By unveiling the secrets of this essential document and following our step-by-step guide, you’ll be able to navigate the process with confidence and precision. Say goodbye to confusion and hello to financial empowerment as you conquer the W4 form like a pro in 2025!

W4 Form 2025 How To Fill Out

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

irs form w-4 walkthrough, employee's withholding certificate (2025)

i.ytimg.com

:max_bytes(150000):strip_icc()/IRSFormW4-e498685ca7d941dca203c1b3b05b9b9f.png)

w-4: how to fill out the 2025 tax withholding form

www.investopedia.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

how to fill out w4? : r/tax

preview.redd.it

.png?width=3200&height=2851&name=MicrosoftTeams-image%20(111).png)

step-by-step guide for filling out the 2024 w-4 form | baron payroll

www.baronpayroll.com

how to fill out the 2024 w-4?!? : r/tax

preview.redd.it

das irs-formular w4 für 2025 als pdf ausfüllen | pdf expert

cdn-rdstaticassets.readdle.com

irs releases 2025 form w-4r | wolters kluwer

assets.contenthub.wolterskluwer.com

the 2025 w4: where to find it, how it works and what you'll need. #greenscreen #w4 #taxes #w4form #2025w4 #mrandmrssmith

www.tiktok.com