W4 Form 2025 Instructions – # Unlock Your Tax Magic: W4 Form 2025 Made Easy!

Unveil the Secrets of the W4 Form 2025!

Are you tired of feeling overwhelmed every time tax season rolls around? Do you dread filling out your W4 form and never quite understand what all those numbers and boxes mean? Well, fear not! With our easy tips and tricks, you can unlock the secrets of the W4 form 2025 and take control of your taxes like never before. Say goodbye to confusion and hello to financial empowerment!

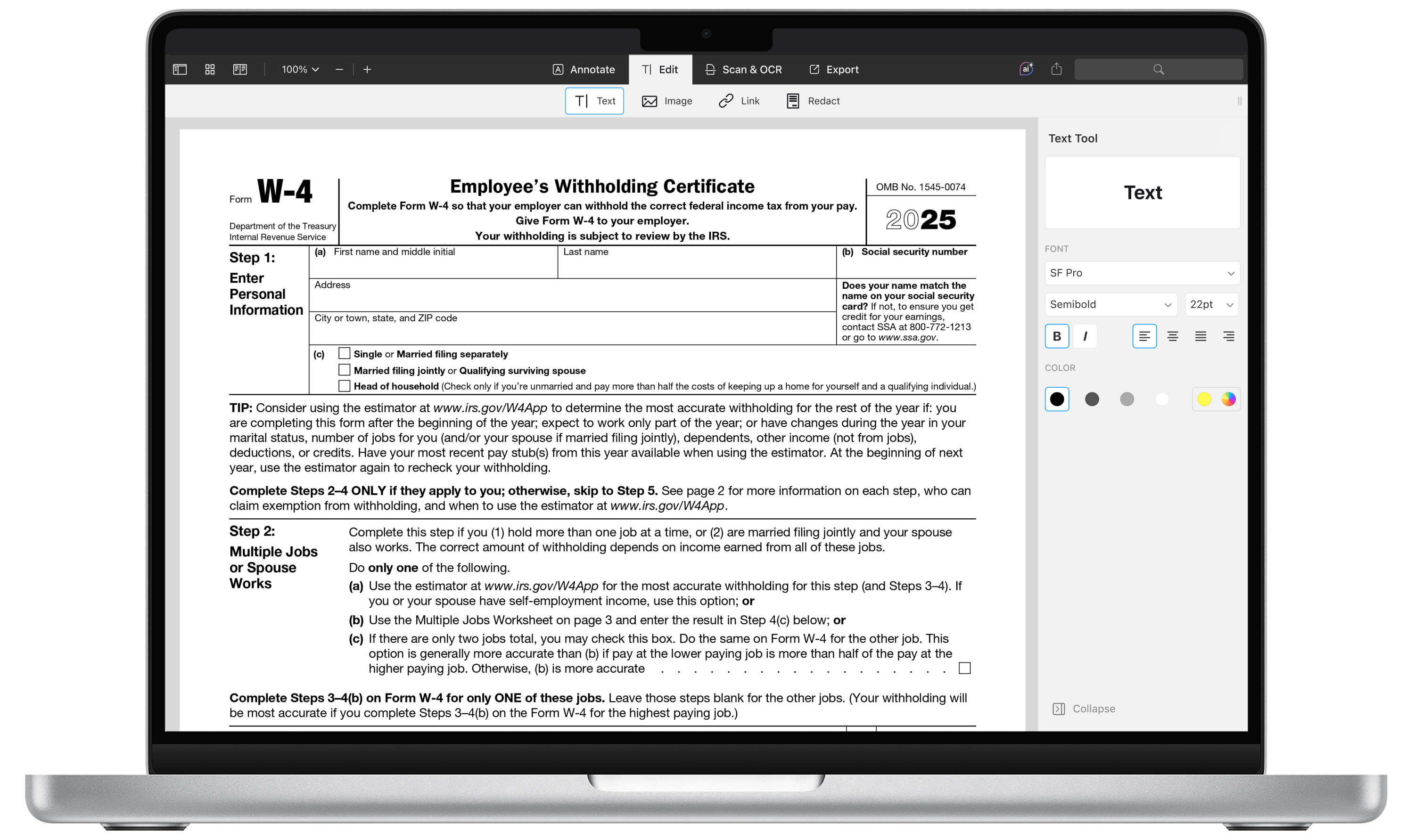

One of the first steps in mastering the W4 form 2025 is understanding your filing status. Are you single, married filing jointly, married filing separately, or head of household? Knowing your filing status will help you determine how much tax you should have withheld from each paycheck. By accurately filling out this section of the form, you can ensure that you are not overpaying or underpaying your taxes throughout the year.

Another key aspect of the W4 form 2025 is claiming allowances. The more allowances you claim, the less tax will be withheld from your paycheck. However, it’s important to be strategic in the number of allowances you claim to avoid owing money come tax time. By carefully assessing your financial situation and considering factors such as dependents and tax credits, you can maximize your take-home pay while still meeting your tax obligations. Don’t be afraid to seek advice from a tax professional if you’re unsure about how many allowances to claim.

Let Your Tax Worries Disappear with These Easy Tips!

Say goodbye to stress and confusion when it comes to your taxes by following these simple tips for filling out your W4 form 2025. First and foremost, keep accurate records of any changes in your financial situation throughout the year. Whether you get married, have a child, buy a house, or experience any other significant life event, these changes can impact how you should fill out your W4 form. By staying on top of these changes, you can ensure that your tax withholding aligns with your current financial circumstances.

Additionally, don’t be afraid to use the IRS’s online withholding calculator to help you determine the right amount of allowances to claim on your W4 form. This handy tool can take the guesswork out of the process and provide you with a personalized recommendation based on your income, deductions, and credits. By using the calculator, you can feel confident that you are making informed decisions about your tax withholding and maximizing your take-home pay.

Finally, don’t forget to review and update your W4 form regularly. Your financial situation can change throughout the year, so it’s important to revisit your withholding allowances periodically to ensure they still reflect your current circumstances. By staying proactive and staying on top of your tax paperwork, you can alleviate stress and avoid any surprises when tax season rolls around.

# Conclusion

With these easy tips and tricks, you can unlock the magic of the W4 form 2025 and take control of your taxes with confidence. By understanding your filing status, claiming allowances strategically, and staying proactive in managing your tax withholding, you can say goodbye to tax worries and hello to financial empowerment. Don’t let the W4 form intimidate you any longer – with a little knowledge and preparation, you can navigate your taxes like a pro. Happy filing!

W4 Form 2025 Instructions

:max_bytes(150000):strip_icc()/IRSFormW4-e498685ca7d941dca203c1b3b05b9b9f.png)

w-4: how to fill out the 2025 tax withholding form

www.investopedia.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

2025 form w-4r

irs form w-4 walkthrough, employee's withholding certificate (2025)

i.ytimg.com

how to fill out irs w4 form 2025 pdf | pdf expert

cdn-rdstaticassets.readdle.com

here's how to fill out the 2025 w-4 form | gusto

prod.gusto-assets.com

w4 form (2025) | fill and sign online with lumin

imagedelivery.net

.png?width=3200&height=2851&name=MicrosoftTeams-image%20(111).png)

step-by-step guide for filling out the 2024 w-4 form | baron payroll

www.baronpayroll.com

how to complete the w-4 tax form | the georgia way

static2.businessinsider.com

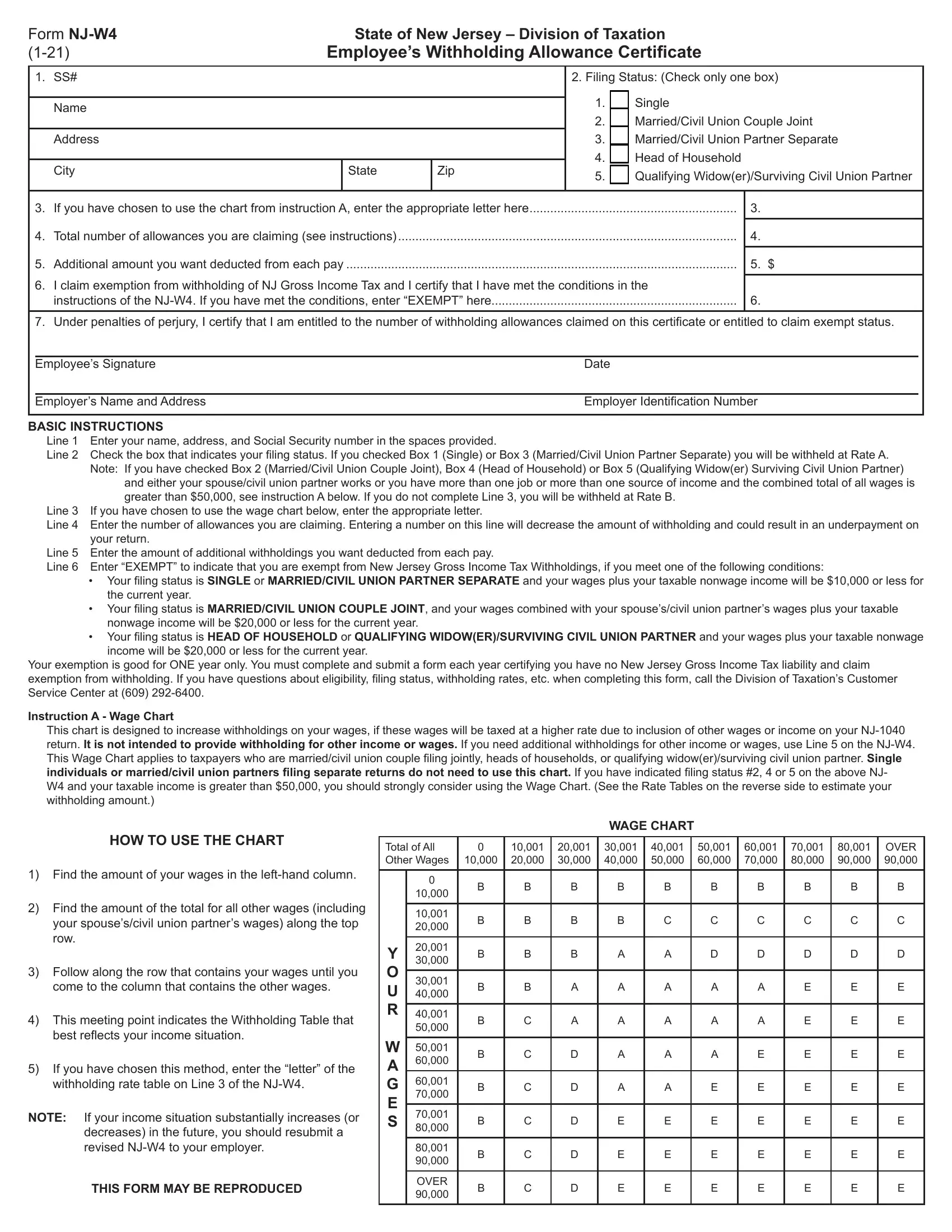

form nj w4 ≡ fill out printable pdf forms online

formspal.com