TIN Number – The IRS must procedure a huge quantity of data involving numerous millions of US citizens. It is not only the volume of information that makes organizing it difficult, but additionally the difficulty of figuring out people. Because they often overlap with one an additional, there has to be considered a regular tax system that will keep track of folks aside from their names. This is the objective of the What Is TIN.

What is the TIN number?

The Taxpayer Identification Number is a sequence of numbers the Internal Revenue Service utilizes to recognize taxpayers. The TIN number is really a broad term that includes numerous varieties of identification numbers for submitting tax for entities and people .

TIN can be issued possibly from the IRS (or even the Social Security Administration, (SSA). SSA issued only Social Security number (SSN) TINs, while IRS issued all other kinds.

What are the Several types of TINs

TIN, as mentioned over, is really a term that addresses several varieties identification numbers. Each and every sort is created up of nine digits.

Listed here are five types of Taxpayer Identification Numbers:

1. Social Security Number (SSN)

This number is issued to folks (citizens or permanent citizens) that are short-term citizens in the U.S. SSN could be formatted as xxxxx-xxxxxx. This number is important to become qualified for authorized employment inside the United States, along with to get government services like social security rewards.

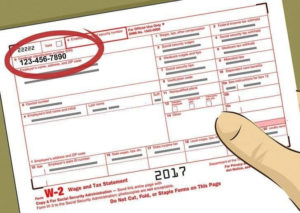

2. Employer Identification Number (EIN)

The IRS makes use of EIN to identify tax-eligible folks, trusts, estates, or businesses . The employer’s tax ID number also has nine digits. It really is formatted in xxxxxxxxxxx, much like the SSN.

3. Individual Taxpayer Identification Numbers (ITIN)

The IRS concerns ITINs to specific non-resident aliens as well as their dependents and spouses . It is arranged inside the identical method as SSN as xxxx-xxxxxx. ITIN always starts with the number 9.

4. Taxpayer Identification Number for Pending U.S. Adoptions (ATIN)

ATIN can only be utilized for domestic adoption if the adoptive mother and father are not able to acquire the SSN of their child.

5. Preparer Taxpayer Identification Numbers (PTIN)

The IRS problems a number of digits known as PTIN that is accustomed to determine tax return preparers. This number serves as the tax return preparer’s identification number. It ought to be hooked up for the segment entitled “Paid Preparer” within the tax return which has been arranged for payment.

When needed to provide a TIN number, the vast majority of people use their Social Security numbers. Whenever they do not employ others, one proprietors can choose to make use of EIN or SSN. Businesses, partnerships, trusts and estates must provide the IRS using an EIN.

How come I want TIN?

The Taxpayer Identification number is actually a necessary product that taxpayers should provide after they file their tax returns every year to the IRS. It’ll be utilized by the IRS to recognize them much like their name. Taxpayers must include the number in any documents related to tax filings or when they are likely to assert advantages or services from your government.

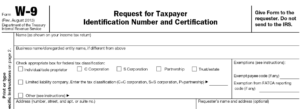

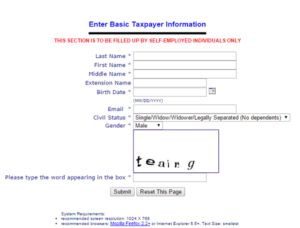

How do I use for a TIN?

You can implement towards the IRS or SSA to acquire your tax identification number. Click this link: https://tinidentificationnumber.com/#How_Do_I_Apply_For_TIN to learn more How to Apply For a TIN Number.